Axe Finance - A Global Leading Provider of Digital Lending Software

Corporate Loans||Commercial Loans||Retail Loans||Islamic Banking||FI Loans||Sovereign Loans||Development Banking||Mortgage Loans||Embedded Finance||Credit Cards||Loan Collectors||Loan Servicers

Solutions by Segment

Axe Credit Portal - ACP

A multi-segment Digital Lending Solution

Solutions by Use Case

Credit Lifecycle Automation from

Why automating your lending with ?

/ A strategic focus on digital lending

/ More than 20 years of expertise in Lendtech

/ Focus on customer success

/ A global footprint

/ A disruptive innovation approach

/ 40% reinvestment in R&D

/ An ISO 27001-certified partner

/ Agile implementation strategy

/ Strong integration background

/ Enhancing customer satisfaction

/ Increasing profitability

/ Achieving cost savings

/ Improving efficiency

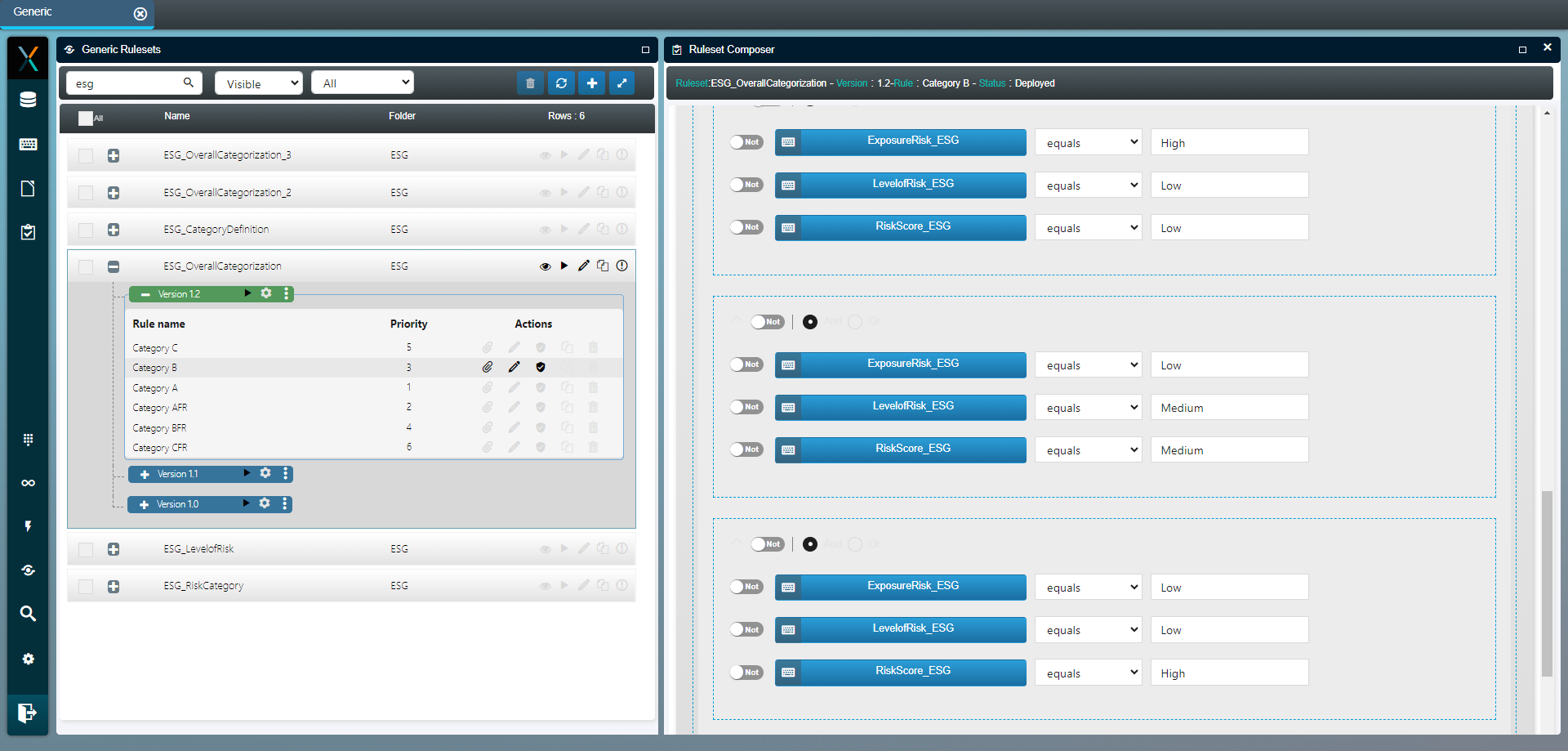

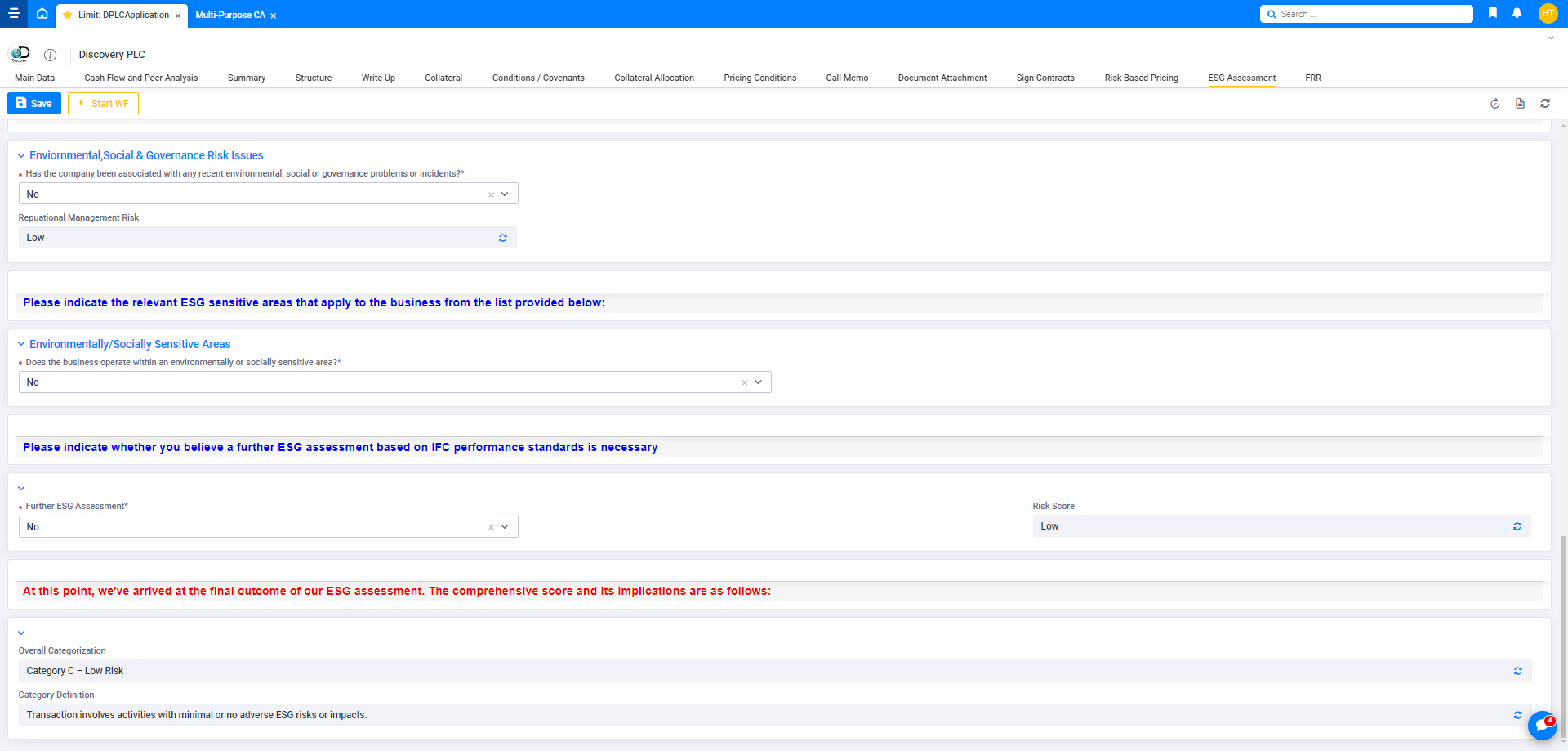

/ Mitigating credit risk

/ Enhancing decision-making quality

/ Reducing loan default

/ Scaling lending operations

/ Ensuring compliance

In their own

LendTech News & Blogs

What’s New at Axe Finance

Company

Axe Finance a Global Market Leader

Focused on digital lending solutions

Focus

Years of Expertise

Users

Countries

Trees saved per day

Reinvestment in r&D

Employees

We’re in

FINTECH

The way you

LEND