Lending Digitalization, lessons learnt from COVID-19 outbreak

Banks sit at the heart of the economy and play a key role in the financial life of each and every individual whether on a personal or business level. Nowadays, it is crucial to keep up with vital activities in order to continue supporting corporates & individuals in this global pandemic outbreak that the world is inevitably going through.

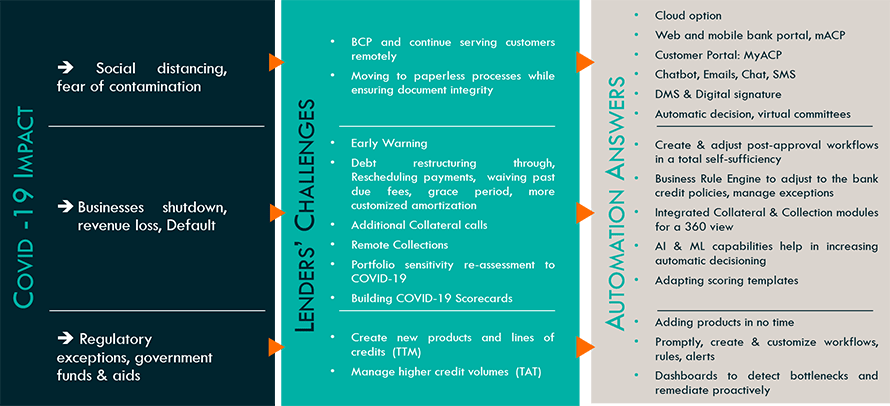

The main focus of this article is to analyze the most common COVID-19 impact, subsequent challenges that lenders are facing and the way a credit automation solution such as ACP helps banks to not only overcome lending problematics smoothly but also to emerge stronger & more efficient.

Covid-19 Challenge 1: promptly serving borrowers while maintaining social distancing

The time has come for businesses all over the world to deep-dive into their Business Continuity Plans and take full advantage of its use, particularly, the vital banking industry. Following the ATAWAD concept (Anytime, Anywhere, Any Device) to serve borrowers was undoubtedly a nice to have feature that has now become a must for lenders.

For that purpose, the omnichannel capabilities of your loan origination software are of great importance in a COVID-19 special context of social distancing. From initiation to disbursement ACP users are able to continue interacting remotely and ensure paperless and safe actions through the credit lifecycle as follows:

Borrowers through MyACP customer portal:

- Initiating a loan from the mobile or Desktop through axeBot and/or through the credit simulation wizard

- Attaching & digitally signing any document

- Rescheduling an installment

- Receiving notification & alerts about special grace period, waiving past dues by email/SMS etc.

Bankers through axeCloud Lending or simply through wACP:

- RM’s, Risk officers and all stakeholders evolve collaboratively in the credit approval process, from KYC/onboarding to analyzing the credit file& instantly chatting internally through ACP about the fate of a loan.

- Digitally signing a contract and send it to the borrower

- Monitor the lending activity of a unit (RM, branch, region)

-> This period will disrupt customers' habits, therefore, banks should support strongly the migration of all its clients to digital channels to benefit from swift credit responses and remote services.

COVID-19 Challenge 2: scrutinize closely NON-PERFORMING loans amid COVID-19 crisis

Banks need to handle repercussions of COVID-19 on hard-hit industries such as tourism, catering, international trade, entertainment, transportation especially small businesses and the self-employed. However, in the mid-term, financial distress will also extend to individuals. Thus, bankers will need to launch a COVID-19 credit policy and rapidly implement it. To do so ACP users may:

Re-assess portfolio sensitivity to COVID-19 crisis:

ACP users are able to initiate and execute a customer check workflow called “COVID-19 Portfolio Review”. For example, requiring from the RM’s to run some checks in order to identify any warning signal through their interaction with them according to “Industry”, “type of client”, “history”, “track-record”, “amount past due”, circumstances such as first recovery, second, “first notice”, “escalation level”, “amount to recover”, etc. They can also set up and run a "COVID-19 Scoring Model" allowing the bank to assess the exposure of its customers to COVID-19 and their sensitivity to the crisis.

Remediate and adapt processes to changing regulations and governmental exceptions:

ACP offers a high level of flexibility not only on the processes but also on the data structure, screen layouts as well as document generation in order to adhere to new regulations resulting from the COVID-19 crisis. Typically, new fields at loan/restructuring application level will indicate that the past dues or loan rescheduling is flagged "COVID-19". This will differentiate the real old past-due loans from those due to COVID-19 and will exclude those from provisioning calculations and reclassifications. This will serve in helping banks to see how their capital requirements are impacted by COVID-19 measures.

Remote access to administration tools to maintain process design without any vendor intervention; thanks to the BRE, the banks adjust credit policies and manage exceptions due to the COVID-19 context. They also use workflow designer to adjust existing workflows or create post-approval ones to defer payments, waiving past due fees, grant grace periods…

Besides, ACP allows bankers to generate real-time alerts based on any event that is configured as an Alert Trigger. The output of these warnings can be a report listing all the transactions or customers likely to be delinquent/doubtful/fraudulent for example. Moreover, Early Warning through configurable behaviors as well as through AI-based warning signal capabilities increase the banks' proactivity and anticipation.

Very powerful case dispatching engine taking into account several criteria like aging, balancing the number of cases and amounts across recovery officers, cyclical distribution, regions, etc. These criteria may be enriched with COVID-19 related ones.

COVID-19 Challenge 3: facing increasing credit volumes while mitigating risk in a precarious period

Be it governmental or upon the bank’s initiative, bankers will definitely face a substantial increase in credit volumes.

Hard-hit businesses will need to rely on financial aids to survive whereas other newly-thriving businesses will need funds to cope with rising demands (Delivery, Medical equipment, e-platforms, IT…)

ACP Loan Origination software allows banks to speeding-up the lending processes while making it fully paperless, removing any process blockers such as manual signatures or physical document exchanges. Lenders can also add new products and conditions in a total self-sufficient hence, reducing Time to Market for COVID-19 specific credit lines

Dashboarding capabilities allow Banks' management to monitor the lending activities and portfolio remotely and in real-time to identify and resolve bottlenecks.

And… Don’t forget to show empathy and provide guidance to your customers in these difficult times

ACP stores customer financials including cash flow analysis as well as customer accounts behavior during the COVID-19 crisis. These rich data storage capabilities allow industry benchmarking and peer analysis to better understand the market trends and practices across a given industry sector. These features allow bankers to better advise their customers based on these analytics.

In short, if you already kicked off the lending automation process, congrats, it makes this crisis more bearable, try to get the most out of your loan origination solution. If not, think about it, the path ahead is hence a precarious one, driven by uncertainty but this pandemic crisis is reshaping the future, it is the right time to start such projects and thoughts. Thus, current investments in credit automation are highly recommended & crucial to continue competing with your peers and serve your borrowers at a very satisfactory level.

Useful Links

- Our Commitments to our community during the COVID-19 crisis

- Our Customers' Stories with Société Générale, Développement International Desjardins, Sterling Bank...

- Lending Digitalization Blog Series # 1: the playing field

- Lending Digitalization Blog Series # 2: Unlock untapped efficiency gains, the case of an eastern european bank

- Lending Digitalization Blog Series # 3: Scale an innovative lending business model through technology