Adapting to Mortgage Regulation Changes: Navigating Opportunities and Challenges for Banks in Kuwait and Qatar

The real estate markets in Qatar and Kuwait are currently undergoing transformative changes, driven by regulatory reforms designed to enhance housing affordability, boost market activity, and ensure long-term financial stability. While Qatar has already established a comprehensive mortgage framework, Kuwait is preparing to introduce a major overhaul of its housing finance system. Both countries are implementing these regulations to create a more structured, transparent, and sustainable market.

However, these changes are also presenting significant challenges for banks, which must adapt their operations, risk management, and compliance frameworks to meet new demands. Here’s a closer look at the key aspects of these regulatory changes and their implications for financial institutions.

Qatar's Mortgage Regulations

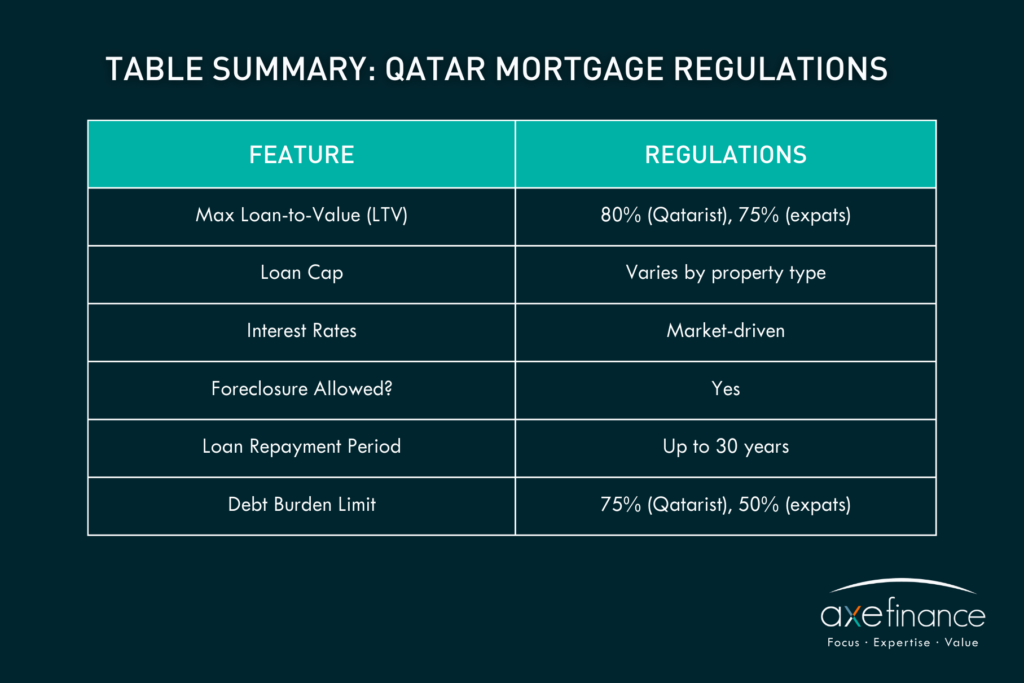

In July 2023, the Qatar Central Bank (QCB) implemented new mortgage regulations to stabilize the real estate market and promote responsible lending practices. Key changes include specific Loan-to-Value (LTV) ratios and tenure limits for different borrower categories. Qatari citizens can now secure up to 80% LTV for personal home purchases valued up to QAR 6 million, with loan tenures extending up to 30 years. Expatriates are subject to slightly lower LTV limits and shorter tenures. Additionally, the QCB has introduced debt burden ratio caps to ensure borrowers do not become overextended financially.

The early results of these reforms are evident. By Q1 2024, mortgage transaction values surged by 90%, reaching QAR 16.8 billion ($14.6 billion), this despite higher interest rates. While this growth has presented significant opportunities for banks, it has also resulted in an uptick in non-performing loans (NPLs), rising from 1.9% in 2019 to 3.9% in 2023. This trend highlights the increased need for robust risk management systems as lending activity expands.

Challenges for Banks in Qatar

Rising Non-Performing Loans (NPLs)

The surge in mortgage activity in Qatar has contributed to a rise in non-performing loans (NPLs), highlighting the need for stricter checks and controls to ensure the suitability and affordability of mortgage products. In response, banks are increasingly leveraging sophisticated risk models to predict potential defaults and safeguard financial stability. Enhanced underwriting processes, coupled with advanced analytics, are playing a crucial role in mitigating risk and reinforcing the resilience of the mortgage sector.

Compliance with Loan-to-Value (LTV) and Debt Burden Ratio Caps

The QCB's regulatory caps place a heavy compliance burden on banks, requiring real-time enforcement of LTV and debt burden limits. Automated compliance tools are essential to ensure adherence and minimize the risk of issuing non-compliant loans.

Operational Strain from Increased Loan Volume

With a 90% increase in mortgage applications, banks need to optimize their operations for efficiency. Embracing digital loan origination platforms can streamline processes, minimize manual work, strengthen controls, and accelerate approvals—all while enhancing the customer experience and improving turnaround times.

Competitive Interest Rates and Profitability

As banks expand their mortgage portfolios, competitive interest rates put pressure on profit margins. To stay competitive while maintaining profitability, banks must adopt data-driven pricing models and risk-adjusted lending strategies.

Kuwait's Mortgage Regulations

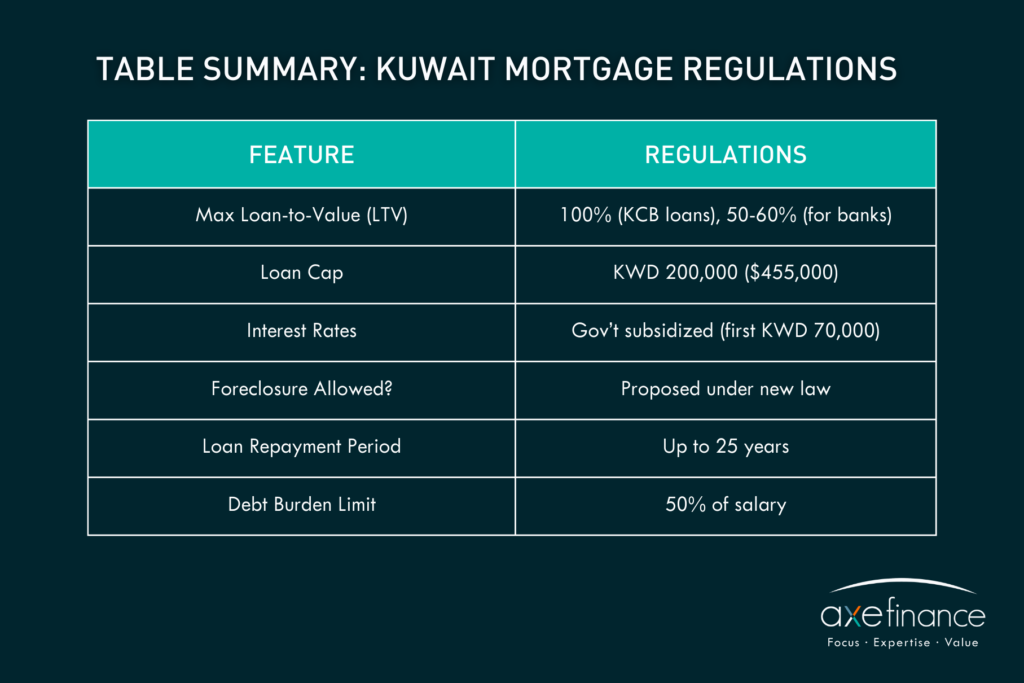

Kuwait is on the brink of a significant mortgage reform set to take effect in 2025. This legislation aims to address a long-standing housing shortage and invigorate the real estate market by enabling commercial banks to offer mortgages. Under the proposed law, banks will be able to offer loans up to KWD 200,000 ($649,000), with the government subsidizing interest on the first KWD 70,000. The loan repayment period will extend to 25 years, and the debt-to-income ratio cap will increase from 40% to 50%. One of the most critical aspects of the proposed law is the introduction of foreclosure provisions, which will allow banks to seize properties in cases of default—helping reduce credit risk and encouraging greater lending activity.

The impact on banks is expected to be profound. With over 100,000 pending housing applications, banks anticipate a significant boost in loan growth, potentially increasing lending by 3.5%–4% annually. However, concerns remain regarding the profitability of these new mortgage products, particularly due to the uncertainty around mortgage pricing and the Central Bank of Kuwait’s regulation of retail banking products.

Challenges for Banks in Kuwait

Uncertainty in Mortgage Pricing

With government subsidies and an unclear final pricing structure for mortgages, banks face difficulty in predicting the long-term profitability of these new offerings. Financial institutions must adopt flexible pricing strategies, using predictive financial models to adjust to regulatory shifts.

Managing Risk in a Newly Liberalized Market

The shift from a state-controlled mortgage sector to a more competitive market brings with it new risks. Banks will need to enhance their risk assessment models, leveraging AI-driven tools to ensure accurate credit evaluations and mitigate potential defaults.

Processing a Large Backlog of Housing Applications

With over 100,000 pending housing applications, banks must scale their operations rapidly. Implementing advanced loan processing solutions, including automated document verification and AI-powered credit scoring, will allow banks to manage increased demand without compromising speed or accuracy.

Debt-to-Income (DTI) Limitations

The proposed increase in the DTI cap to 50% raises concerns about borrower affordability and potential overleveraging. To manage this risk, banks must adopt enhanced financial analysis tools that provide a comprehensive view of borrowers' repayment capacity, ensuring that higher DTI thresholds do not result in financial distress.

Digital Transformation to Enhance Efficiency

Successfully handling the surge in mortgage applications and ensuring compliance with new regulations will require a shift toward digitalization. Banks must invest in digital lending platforms that offer automation, workflow optimization, and real-time regulatory enforcement to efficiently navigate the evolving mortgage landscape.

How the Right Digital Lending Solution Can Address These Challenges:

Automation and Efficiency in Loan Processing

The right digital lending solution can streamline the entire mortgage application process by automating key tasks, including document verification, credit assessment, and approval workflows. This reduces loan approval times from weeks to days, significantly improving operational efficiency and reducing the manual workload for bank staff.

Ensuring Regulatory Compliance

Advanced digital lending solutions automatically enforce key regulatory requirements, such as LTV ratios, DTI caps, and debt burden limits. By automating compliance checks in real time, these solutions ensure that loans remain within regulatory guidelines, minimizing the risk of non-compliant loans and ensuring consistent adherence to local regulations.

Enhanced Risk Management

Digital lending solutions integrate predictive analytics and fraud detection algorithms, enabling banks to assess borrower default risks more accurately. These tools can detect inconsistencies in financial documents, analyze borrower behavior patterns, and monitor repayment capacity to reduce non-performing loans and promote financial stability.

Profitability and Pricing Flexibility

A flexible system can help banks navigate uncertain mortgage pricing by offering dynamic adjustments based on changing regulatory conditions. Additionally, these enable financial institutions to model various profitability scenarios, helping them make informed decisions about loan pricing while maintaining financial sustainability.

Improved Customer Experience

By providing digital self-service mortgage applications, automated approval processes, and instant notifications, digital lending solutions create a seamless and user-friendly experience for borrowers. Additionally, AI-driven insights allow banks to personalize mortgage offers, improving customer satisfaction and increasing the likelihood of successful loan origination.

How Axe Credit Portal (ACP) Can Help Banks Successfully Adapt

To effectively navigate these regulatory changes and seize new opportunities, banks require a robust digital lending solution. Axe Credit Portal (ACP) provides the necessary tools to streamline operations, ensure compliance, and optimize risk management. With ACP, banks can:

/ Adjust Mortgage Pricing Dynamically – ACP’s data-driven pricing models allow banks to respond flexibly to changing regulations and market conditions.

/ Mitigate Credit Risks – Advanced AI-powered risk assessment tools help banks identify potential defaulters and optimize credit scoring models.

/ Create Automated Rules and Workflows – ACP automates compliance enforcement, ensuring real-time adherence to LTV, DTI, and other regulatory limits.

/ Enhance Reporting and Monitoring – The platform provides comprehensive analytics and real-time insights, enabling banks to make data-backed decisions.

/ Reduce Onboarding and Loan Processing Time – ACP accelerates loan approvals from weeks to days by automating document verification, credit assessments, and approvals.

With Axe Credit Portal, banks can not only achieve regulatory compliance but also enhance operational efficiency, reduce risk exposure, and improve customer experience. By embracing digital transformation, banks in Qatar and Kuwait can enhance their operational resilience, improve regulatory compliance, and unlock new growth opportunities in the evolving mortgage market.

In summary, while the Kuwaiti mortgage market faces challenges such as housing shortages, rising costs, and regulatory adjustments, the upcoming reforms in 2025 are poised to address these issues by enhancing mortgage accessibility, diversifying the economy, and improving labor conditions, thereby promoting financial stability and growth in the housing sector.