Adapting to Mortgage Regulation Changes in Kuwait: Navigating Opportunities and Challenges for Banks

Kuwait is preparing for a major overhaul of its housing finance system, set to take effect in 2025. The new legislation will introduce significant reforms aimed at addressing the country’s housing shortage, stimulating the real estate market, and enhancing lending opportunities. While these changes present substantial opportunities for banks, they also come with new challenges.

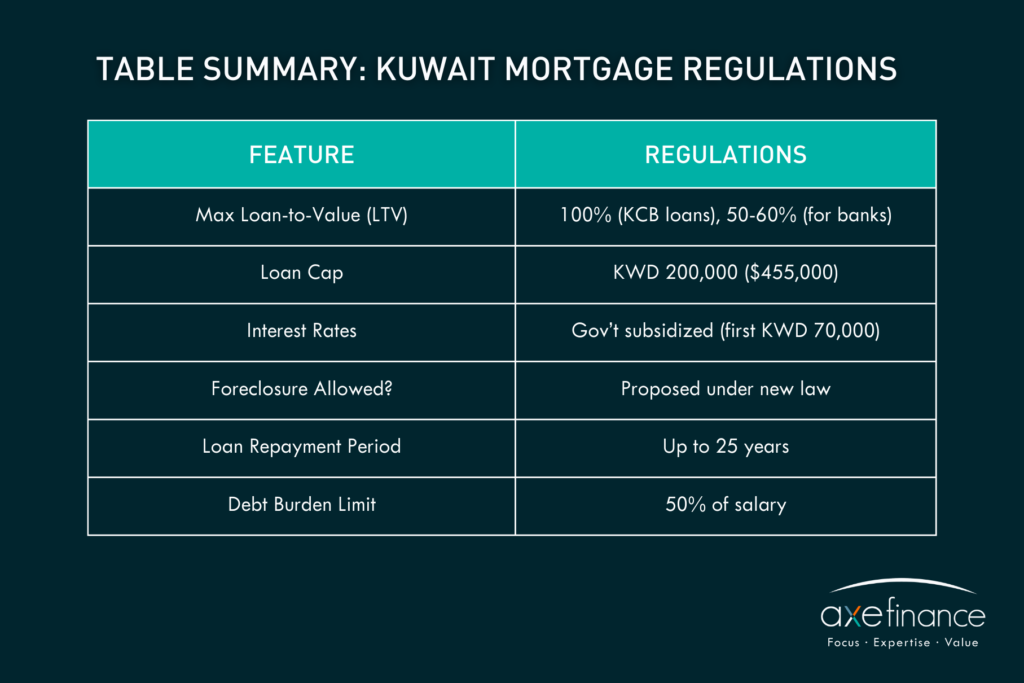

Kuwait's Mortgage Regulations

Kuwait is embarking on significant mortgage reform, which takes effect this year (2025). The new legislation aims to address a long-standing housing shortage and will invigorate the real estate market by enabling commercial banks to offer mortgages. Under the proposed law, banks will be able to offer loans up to KWD 200,000 ($649,000), with the government subsidizing interest on the first KWD 70,000. The loan repayment period will extend to 25 years, and the debt-to-income ratio cap will increase from 40% to 50%. One of the most critical aspects of the proposed law is the introduction of foreclosure provisions, which will allow banks to seize properties in cases of default—helping reduce credit risk and encouraging greater lending activity.

The impact on banks is expected to be profound. With over 100,000 pending housing applications, banks anticipate a significant boost in loan growth, potentially increasing lending by 3.5%–4% annually. However, concerns remain regarding the profitability of these new mortgage products, particularly due to the uncertainty around mortgage pricing and the Central Bank of Kuwait’s regulation of retail banking products.

Challenges for Banks in Kuwait

Uncertainty in Mortgage Pricing

With government subsidies and an unclear final pricing structure for mortgages, banks face difficulty in predicting the long-term profitability of these new offerings. Financial institutions must adopt flexible pricing strategies, using predictive financial models to adjust to regulatory shifts.

Managing Risk in a Newly Liberalized Market

The shift from a state-controlled mortgage sector to a more competitive market brings with it new risks. Banks will need to enhance their risk assessment models, leveraging AI-driven tools to ensure accurate credit evaluations and mitigate potential defaults.

Processing a Large Backlog of Housing Applications

With over 100,000 pending housing applications, banks must scale their operations rapidly. Implementing advanced loan processing solutions, including automated document verification and AI-powered credit scoring, will allow banks to manage increased demand without compromising speed or accuracy.

Debt-to-Income (DTI) Limitations

The proposed increase in the DTI cap to 50% raises concerns about borrower affordability and potential overleveraging. To manage this risk, banks must adopt enhanced financial analysis tools that provide a comprehensive view of borrowers' repayment capacity, ensuring that higher DTI thresholds do not result in financial distress.

Digital Transformation to Enhance Efficiency

Successfully handling the surge in mortgage applications and ensuring compliance with new regulations will require a shift toward digitalization. Banks must invest in digital lending platforms that offer automation, workflow optimization, and real-time regulatory enforcement to efficiently navigate the evolving mortgage landscape.

How the Right Digital Lending Solution Can Address These Challenges:

To navigate these regulatory changes, banks in Kuwait can leverage digital lending solutions to:

/ Automate Loan Processing: Streamline tasks such as document verification, credit scoring, and approval workflows, reducing processing times.

/ Ensure Regulatory Compliance: Enforce DTI caps and other regulatory limits automatically in real-time, minimizing compliance risks.

/ Enhance Risk Management: Use AI to analyze borrower behavior and default risks, improving risk mitigation strategies.

/ Improve Profitability and Flexibility: Adopt dynamic pricing models that allow banks to adjust loan terms and conditions based on market and regulatory changes.

Axe Credit Portal (ACP) offers a comprehensive solution for banks in Kuwait to navigate these changes. ACP enables banks to automate compliance enforcement, optimize risk management, and reduce loan processing times, all while enhancing customer experience and profitability.f

By embracing digital transformation, banks in Kuwait can not only adapt to these new regulations but also seize new growth opportunities in the evolving mortgage market.