Adapting to Mortgage Regulation Changes in Qatar: Navigating Opportunities and Challenges for Banks

The real estate market in Qatar is undergoing transformative changes, with the Qatar Central Bank (QCB) implementing new mortgage regulations to ensure financial stability, increase housing affordability, and promote responsible lending practices. As a result, both banks and borrowers are facing new opportunities and challenges.

However, these changes are also presenting significant challenges for banks, which must adapt their operations, risk management, and compliance frameworks to meet new demands. Here’s a closer look at the key aspects of these regulatory changes and their implications for financial institutions.

Qatar's Mortgage Regulations

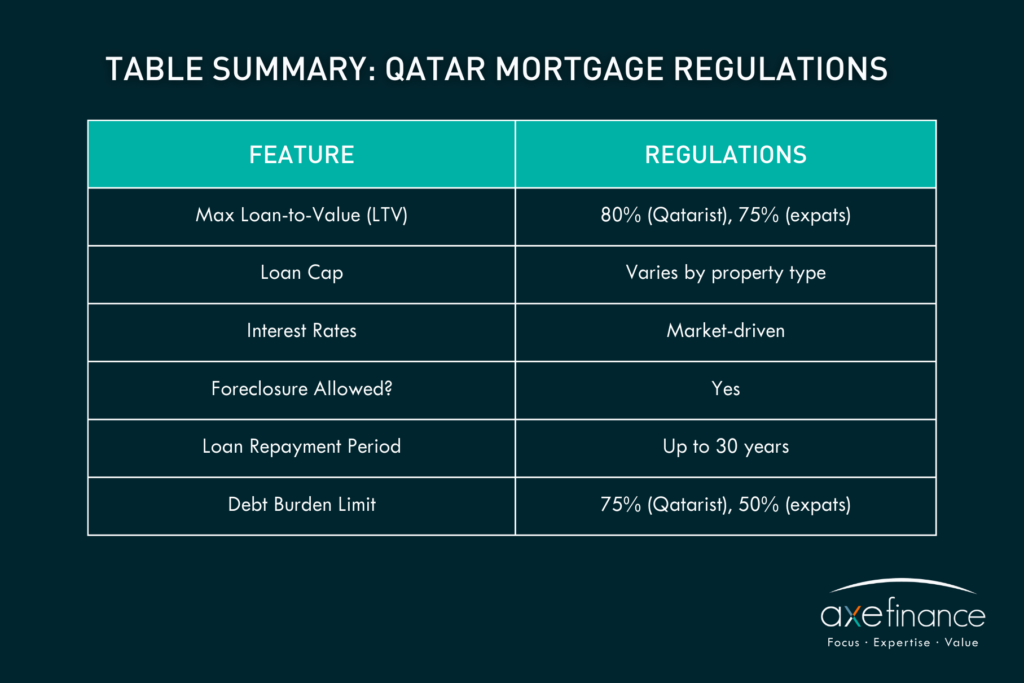

In July 2023, the Qatar Central Bank (QCB) implemented new mortgage regulations to stabilize the real estate market and promote responsible lending practices. Key changes include specific Loan-to-Value (LTV) ratios and tenure limits for different borrower categories. Qatari citizens can now secure up to 80% LTV for personal home purchases valued up to QAR 6 million, with loan tenures extending up to 30 years. Expatriates are subject to slightly lower LTV limits and shorter tenures. Additionally, the QCB has introduced debt burden ratio caps to ensure borrowers do not become overextended financially.

The early results of these reforms are evident. By Q1 2024, mortgage transaction values surged by 90%, reaching QAR 16.8 billion ($14.6 billion), this despite higher interest rates. While this growth has presented significant opportunities for banks, it has also resulted in an uptick in non-performing loans (NPLs), rising from 1.9% in 2019 to 3.9% in 2023. This trend highlights the increased need for robust risk management systems as lending activity expands.

Challenges for Banks in Qatar

Rising Non-Performing Loans (NPLs)

The surge in mortgage activity in Qatar has contributed to a rise in non-performing loans (NPLs), highlighting the need for stricter checks and controls to ensure the suitability and affordability of mortgage products. In response, banks are increasingly leveraging sophisticated risk models to predict potential defaults and safeguard financial stability. Enhanced underwriting processes, coupled with advanced analytics, are playing a crucial role in mitigating risk and reinforcing the resilience of the mortgage sector.

Compliance with Loan-to-Value (LTV) and Debt Burden Ratio Caps

The QCB's regulatory caps place a heavy compliance burden on banks, requiring real-time enforcement of LTV and debt burden limits. Automated compliance tools are essential to ensure adherence and minimize the risk of issuing non-compliant loans.

Operational Strain from Increased Loan Volume

With a 90% increase in mortgage applications, banks need to optimize their operations for efficiency. Embracing digital loan origination platforms can streamline processes, minimize manual work, strengthen controls, and accelerate approvals—all while enhancing the customer experience and improving turnaround times.

Competitive Interest Rates and Profitability

As banks expand their mortgage portfolios, competitive interest rates put pressure on profit margins. To stay competitive while maintaining profitability, banks must adopt data-driven pricing models and risk-adjusted lending strategies.

How the Right Digital Lending Solution Can Address These Challenges:

To navigate these regulatory changes, banks in Qatar can leverage digital lending solutions to:

/ Automate Loan Processing: Automate tasks like document verification and credit assessments, reducing approval times.

/ Ensure Regulatory Compliance: Automate the enforcement of LTV ratios and debt burden caps in real-time.

/ Enhance Risk Management: Use predictive analytics to assess default risks accurately and monitor repayment capacity.

/ Improve Customer Experience: Offer self-service options and personalized mortgage offers to enhance satisfaction.

A robust digital lending solution like Axe Credit Portal (ACP) can provide the necessary tools to streamline operations, ensure compliance, and manage risk effectively. With ACP, banks in Qatar can unlock new growth opportunities and enhance their operational resilience in this evolving market.