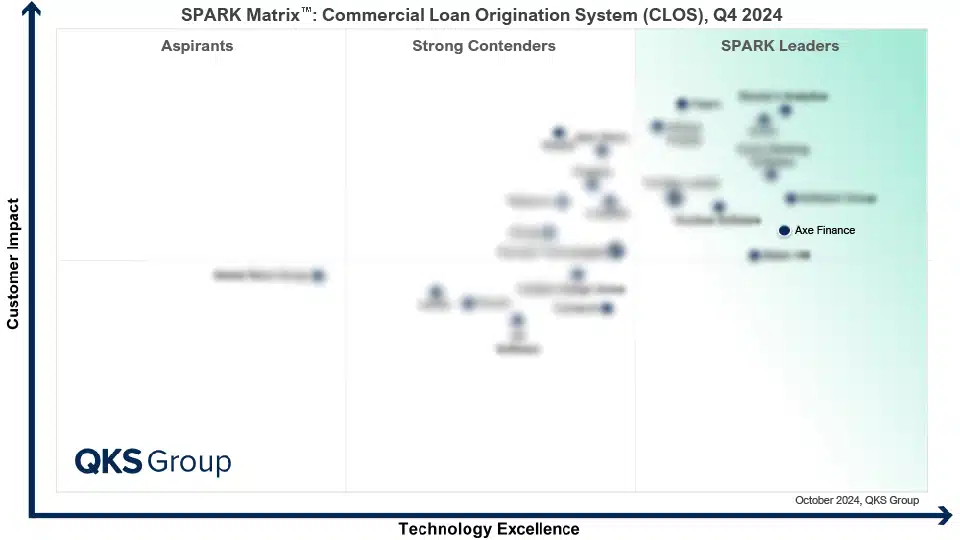

Axe Finance Positioned as the Leader in the 2024 SPARK Matrix for Commercial Loan Origination Systems by QKS Group

- The QKS Group SPARK Matrix™ provides competitive analysis and ranking of the leading Cloud Cost Management and Optimization vendors.

- Axe Finance, with its comprehensive technology and customer experience management, has received strong ratings across the parameters of technology excellence and customer impact.

QKS Group has named Axe Finance as a technology leader in their 2024 SPARK Matrix™ analysis of market.

SPARK Matrix: Commercial Loan Origination Systems, 2024

The QKS Group SPARK Matrix™ evaluates vendors based on technology excellence and customer impact. It offers an in-depth analysis of global market dynamics, major trends, vendor landscapes, and competitive positioning. By providing a competitive analysis and ranking of leading technology vendors, the SPARK Matrix delivers strategic insights that help users assess provider capabilities, differentiate competitively, and understand market positions.

Axe Finance was chosen as a leader in the 2024 SPARK Matrix for Commercial Loan Origination Systems due to its outstanding capabilities in optimizing cloud costs and enhancing operational efficiency in complex multi-cloud environments.

QKS Group defines Commercial Loan Origination Systems (CLOS) as a comprehensive software solution designed to streamline and manage the entire commercial lending process. This includes tasks such as loan origination, processing, distribution, and monitoring for organizations of all sizes, from large enterprises to small and mid-sized businesses. Typical CLOS software encompasses various modules, including application generation, KYC processing, underwriting, documentation, loan servicing, and delinquency management. An end-to-end CLOS solution enables organizations to increase revenue, effectively manage risk, enhance operational efficiency, and deliver seamless customer experiences.

“According to Sriram S R, Senior Analyst at QKS Group, “Axe Finance offers a robust solution for financial institutions seeking to streamline their commercial loan origination processes. With its emphasis on automation, integration, and advanced analytics, Axe Finance enables organizations to enhance operational efficiency and optimize credit decisioning. The platform's comprehensive feature set supports dynamic credit policy creation, real-time risk assessment, and seamless document management, addressing key challenges in loan origination and compliance. Axe Finance's commitment to innovation and customer-centricity positions it favorably in the competitive financial technology landscape, making it a viable choice for institutions aiming to optimize their lending processes and drive digital transformation.” With its comprehensive functional capabilities, strong customer value proposition, and compelling ratings across customer impact and technology excellence parameters, Axe Finance has been recognized as a leader in the 2024 SPARK Matrix™: Commercial Loan Origination Systems,” adds Sriram.”

Quote by Axe Finance

“We are honored to be recognized as leaders by QKS Group in its 2024 SPARK Matrix for Commercial Loan Origination Systems report. We believe this recognition not only validates our commitment to innovation but also underscores our position as a leading global provider of cutting-edge digital loan origination solutions and highlights the effectiveness of our modular software solution, Axe Credit Portal (ACP), in meeting the complex needs of the fast-growing Commercial lending market.”

The commercial loan origination system (CLOS) market has seen significant growth driven by the need to streamline lending processes for financial institutions (FIs) and enhance customer experience. Legacy systems, hampered by slow processing speeds and lack of workflow support, have struggled to keep pace with the rapid digital transformation. CLOS addresses these challenges by automating the entire loan lifecycle, from borrower application management and credit analysis to underwriting and decision-making. This system integrates advanced functionalities like document management, risk assessment, and rule-based workflows, reducing manual effort and improving efficiency for loan officers and underwriters. CLOS vendors are increasingly leveraging AI, machine learning (ML), and big data analytics to further enhance the system’s capabilities. These technologies enable predictive analytics, automated financial analysis, and improved risk assessment, allowing FIs to make more accurate and timely lending decisions. Mobile applications and AI-powered chatbots are also being developed to improve user engagement and automate customer support. Additionally, cloud computing integration has enhanced scalability, data security, and compliance, ensuring that the system can adapt to regulatory changes and support high-volume lending operations. As CLOS solutions continue to evolve, the market is poised for further innovation, with a focus on deeper automation, predictive analytics, and seamless cloud integration. These advancements will enable financial institutions to optimize their lending operations, reduce costs, and offer more personalized and competitive loan terms to borrowers.

SPARK Matrix: Commercial Loan Origination Systems, 2024

About Axe Finance:

Founded in 2004, Axe Finance is a global market-leading software provider focused on credit risk automation for lenders looking to provide an efficient, competitive, and seamless omnichannel journey.

Axe Finance developed the Axe Credit Portal (ACP) a future-proof AI-driven solution to automate the entire credit lifecycle from KYC to servicing, including origination, credit scoring, and automatic decision-making. ACP is a multi-segment digital lending solution covering not only Retail, Commercial, Corporate, FIs, and Sovereign segments but also other specific types of lending such as Microfinance, BNPL, embedded financing, and Islamic finance. Axe Finance is the trusted partner of reputable banks worldwide such as Société Générale, OTP, Al Rajhi Bank, ADCB, FAB, BBK, Bangkok Bank Limited, and Polaris Bank.

- For more information about Axe Finance

Media Contact:

Email: marketing@axefinance.com

About QKS Group:

QKS Group is a global advisory and consulting firm focused on helping clients achieve business transformation goals with Strategic Business and Growth advisory services. At QKS Group, our vision is to become an integral part of our client’s business as a strategic knowledge partner. Our research and consulting deliverables are designed to provide comprehensive information and strategic insights for helping clients formulate growth strategies to survive and thrive in ever-changing business environments.

For more available research, please visit https://qksgroup.com/

QKS Group Media Contact:

Shraddha Roy

PR & Media Relations

QKS Group

Regus Business Center

35 Village Road, Suite 100,

Middleton Massachusetts 01949

United States

Email: shraddha.r@qksgroup.com