Axe Finance Positioned as the Leader in the 2024 SPARK Matrix for Retail Loan Origination Systems by QKS Group

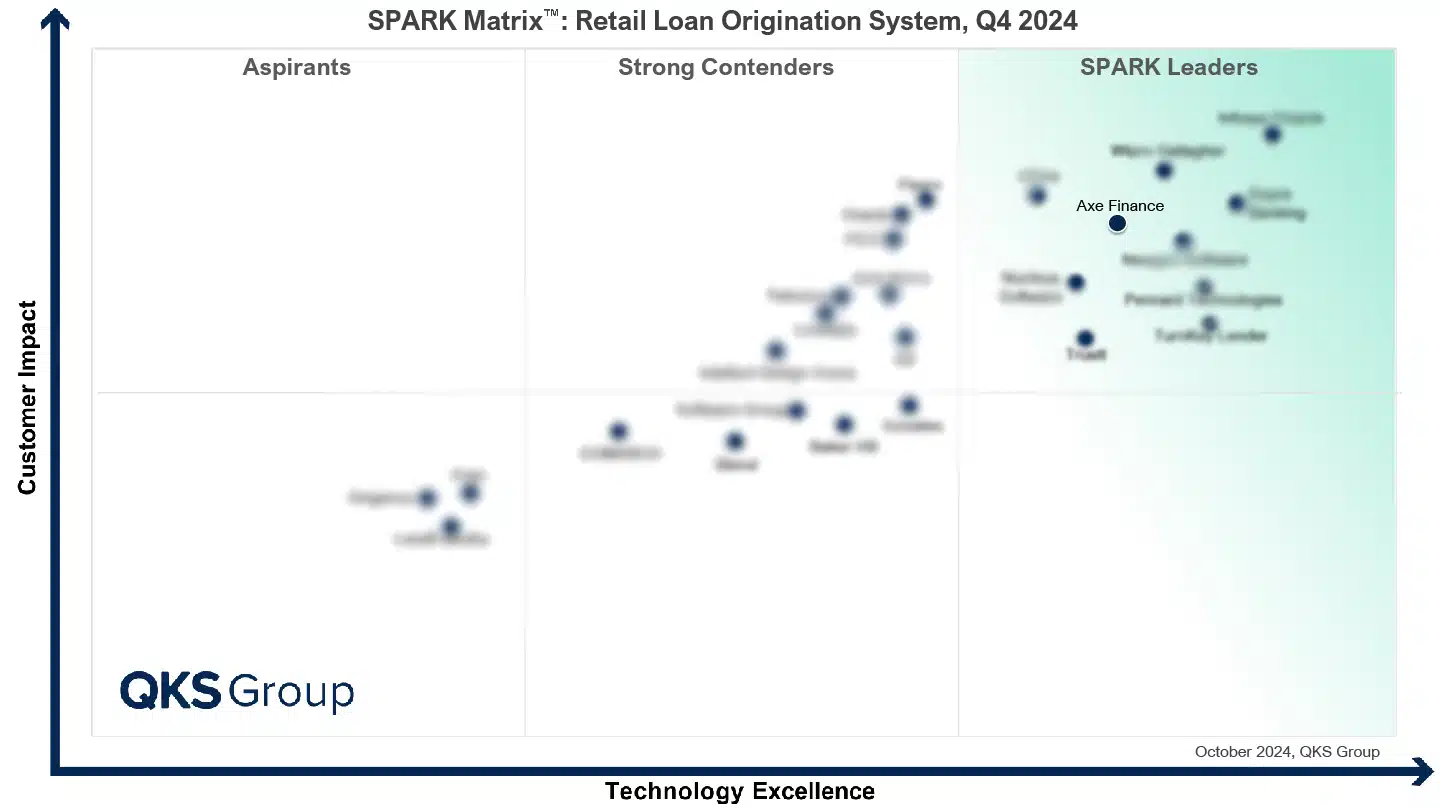

- The QKS Group SPARK Matrix™ provides competitive analysis and ranking of the leading Cloud Cost Management and Optimization vendors.

- Axe Finance with its comprehensive technology and customer experience management, has received strong ratings across the parameters of technology excellence and customer impact.

QKS Group has named Axe Finance as a technology leader in their 2024 SPARK Matrix™ analysis of market.

SPARK Matrix: Retail Loan Origination Systems, 2024

The QKS Group SPARK Matrix™ evaluates vendors based on technology excellence and customer impact. It offers an in-depth analysis of global market dynamics, major trends, vendor landscapes, and competitive positioning. By providing a competitive analysis and ranking of leading technology vendors, the SPARK Matrix delivers strategic insights that help users assess provider capabilities, differentiate competitively, and understand market positions.

Axe Finance was chosen as a leader in the 2024 SPARK Matrix for Retail Loan Origination Systems due to its outstanding capabilities in optimizing cloud costs and enhancing operational efficiency in complex multi-cloud environments.

QKS Group defines Commercial Loan Origination Systems (CLOS) as a specialized software solution designed to streamline and automate the entire loan origination process for financial institutions, from client onboarding to final approval and fund disbursement. By assessing the applicant's credit score, RLOS effectively mitigates the credit risk associated with lending, offering data-driven insights to enhance decision-making in loan issuance. Additionally, the system's advanced automation capabilities enable financial institutions to tailor customer onboarding processes, ensure regulatory compliance throughout the loan origination lifecycle, and optimize credit risk management, all while significantly reducing operational costs.

“According to Sriram S R, Senior Analyst at QKS Group, “Axe Finance offers a robust solution for financial institutions seeking to streamline their retail loan origination processes. With its emphasis on automation, integration, and advanced analytics, Axe Finance enables organizations to enhance operational efficiency and optimize customer-centric credit decisioning. The platform's comprehensive feature set supports flexible loan customization, dynamic credit policy management, and seamless document handling, addressing key challenges in retail lending and regulatory compliance. Axe Finance’s focus on innovation and customer engagement positions it favorably in the competitive fintech landscape, making it a strong choice for institutions aiming to improve their retail lending processes and accelerate digital transformation.” With its comprehensive functional capabilities, strong customer value proposition, and compelling ratings across customer impact and technology excellence parameters, Axe Finance has been recognized as a leader in the 2024 SPARK Matrix™: Retail Loan Origination Systems,” adds Sriram.”

Quote by Axe Finance

“We are honored to be recognized as leaders by QKS Group in its 2024 SPARK Matrix for Retail Loan Origination Systems report. We believe this recognition not only validates our commitment to innovation but also underscores our position as a leading global provider of cutting-edge digital loan origination solutions and highlights the effectiveness of our modular software solution, Axe Credit Portal (ACP), in meeting the complex needs of the fast-growing retail lending market.”

The retail loan origination system (RLOS) market has experienced significant growth as financial institutions seek to streamline lending processes and enhance customer experiences. Legacy systems, burdened by slow processing speeds and lack of workflow support, have struggled to meet modern demands. RLOS addresses these challenges by automating the entire loan lifecycle, including borrower application management, credit analysis, underwriting, and decision-making. By integrating advanced technologies like AI, machine learning (ML), and big data analytics, RLOS improves credit assessment, risk management, and operational efficiency. Mobile applications, robotic process automation (RPA), and cloud computing further enhance user engagement, scalability, and compliance, enabling financial institutions to adapt to evolving regulatory requirements while offering personalized, cost-effective loan services. As RLOS solutions evolve, the market is set to focus on deeper automation, predictive analytics, and seamless cloud integration to optimize lending operations.

SPARK Matrix: Retail Loan Origination Systems, 2024

About Axe Finance:

Founded in 2004, Axe Finance is a global market-leading software provider focused on credit risk automation for lenders looking to provide an efficient, competitive, and seamless omnichannel journey.

Axe Finance developed the Axe Credit Portal (ACP) a future-proof AI-driven solution to automate the entire credit lifecycle from KYC to servicing, including origination, credit scoring, and automatic decision-making. ACP is a multi-segment digital lending solution covering not only Retail, Commercial, Corporate, FIs, and Sovereign segments but also other specific types of lending such as Microfinance, BNPL, embedded financing, and Islamic finance. Axe Finance is the trusted partner of reputable banks worldwide such as Société Générale, OTP, Al Rajhi Bank, ADCB, FAB, BBK, Bangkok Bank Limited, and Polaris Bank.

- For more information about Axe Finance

Media Contact:

Email: marketing@axefinance.com

About QKS Group:

QKS Group is a global advisory and consulting firm focused on helping clients achieve business transformation goals with Strategic Business and Growth advisory services. At QKS Group, our vision is to become an integral part of our client’s business as a strategic knowledge partner. Our research and consulting deliverables are designed to provide comprehensive information and strategic insights for helping clients formulate growth strategies to survive and thrive in ever-changing business environments.

For more available research, please visit https://qksgroup.com/

QKS Group Media Contact:

Shraddha Roy

PR & Media Relations

QKS Group

Regus Business Center

35 Village Road, Suite 100,

Middleton Massachusetts 01949

United States

Email: shraddha.r@qksgroup.com