SEGMENT

ACP EMBEDDED LOANS

A realm of new revenue streams unlocked for retailers and service providers

Retailers are constantly searching for innovative financing solutions to retain customers, yet the lack of suitable options limits their adaptability in a dynamic market. ACP Embedded Loans revolutionizes financing, whether in-store or online, by facilitating rapid loan disbursements directly at the Point-of-Sale (POS). This empowers banks to collaborate with retailers, transforming them into digital credit enablers and unlocking fresh revenue streams.

Download ACP Embedded Finance product sheet

Fostering bank partners' success with innovative financing solutions at the POS

Point-of-Sale (POS) Financing

Buy Now, Pay Later (BNPL)

Real Estate Embedded Finance

In-App Financing

Embedded Auto financing

Embedded SMB financing

Embedded Credit Card

A future-proof Embedded finance software

AI-Powered Embedded Loan Solution, from KYC to Servicing

- Instant digital onboarding powered by AI capabilities

- Tailor-made KYC forms for personalized Customer Experience

- Seamlessly initiate loans while browsing partner online/offline shops or mobile apps

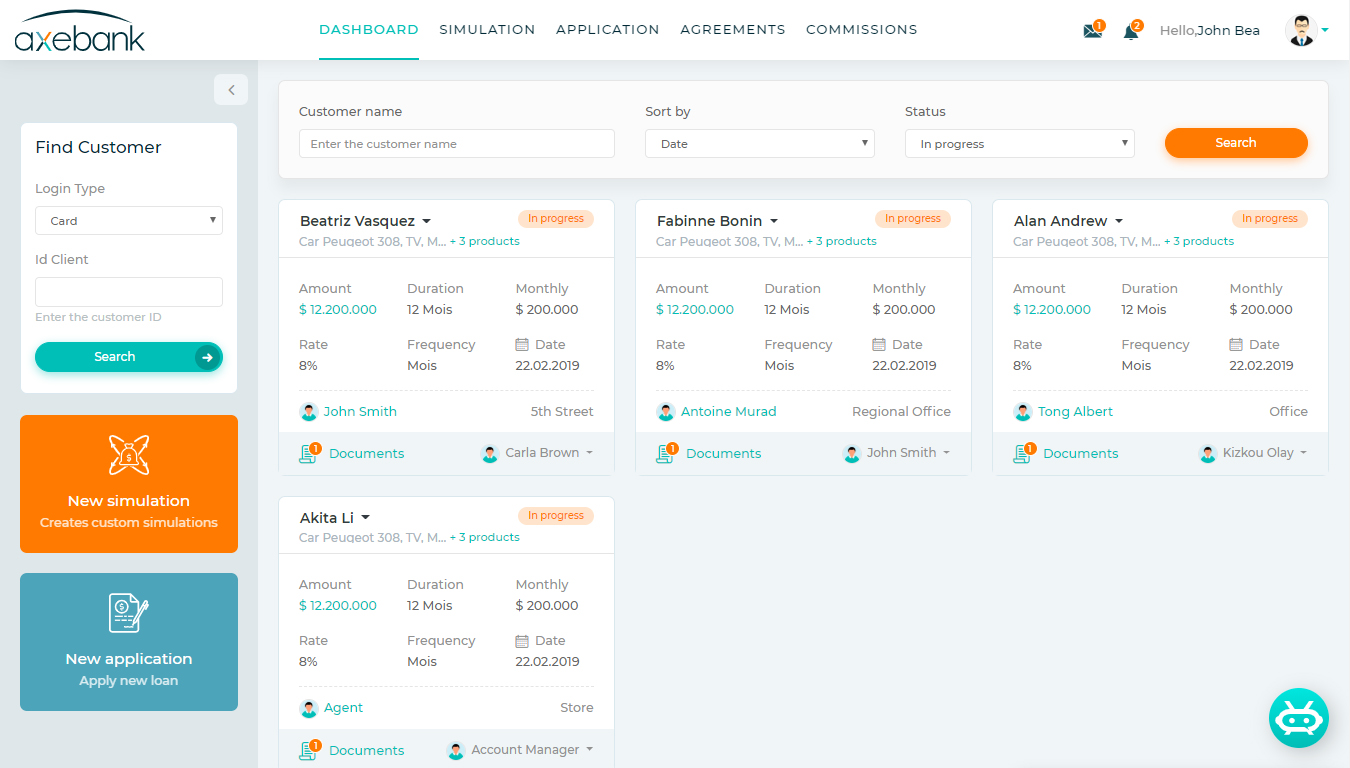

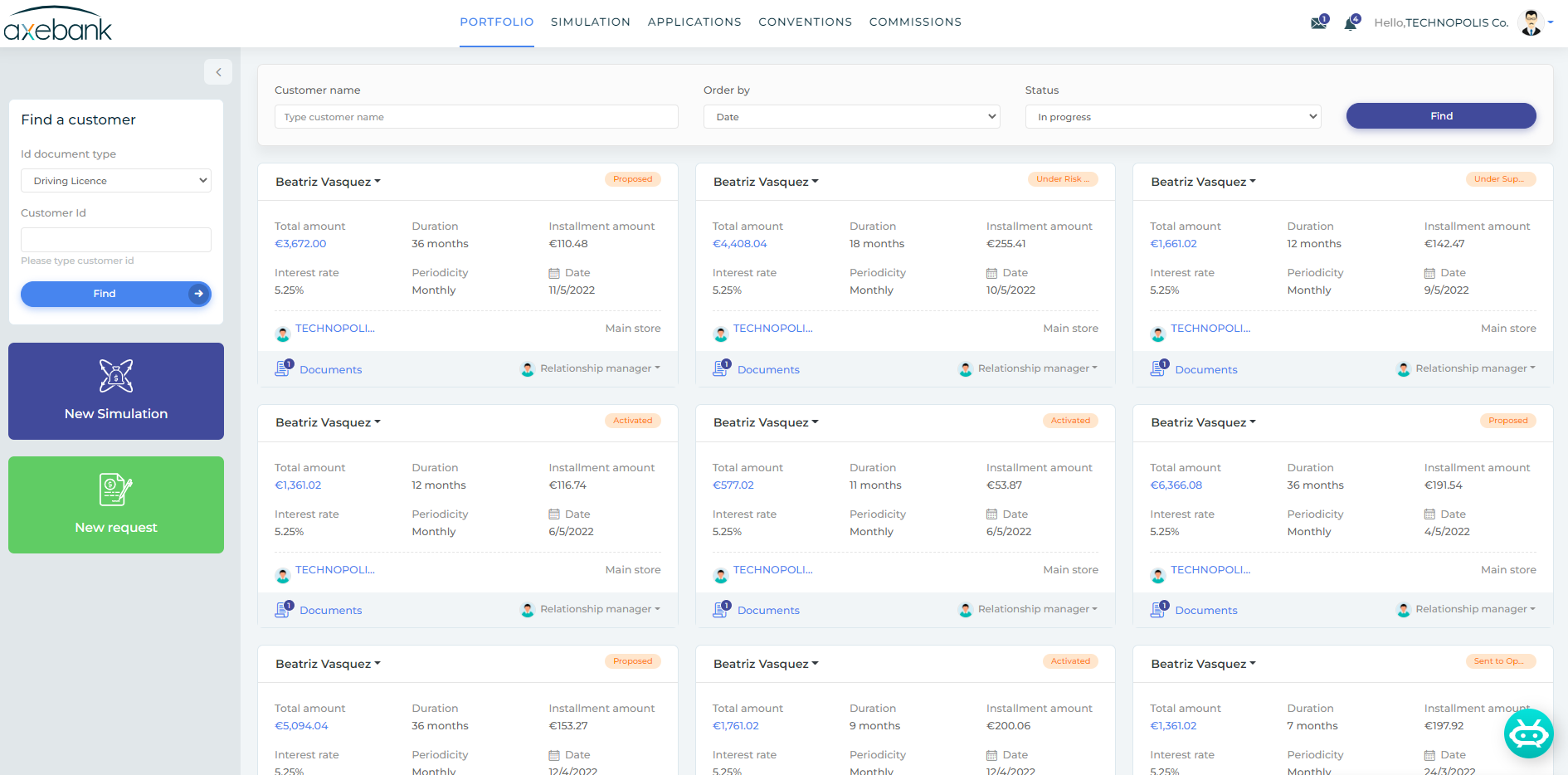

- Effortlessly originate loans through ACP embedded loans workspace or Integrated Sales/CRM/KYC Platforms

- Convenient On-the-Go document submission for all parties across every channel

- Tailored pricing and approval workflows aligned with partner industry verticals

- Seamless risk mitigation enabled by ACP Embedded Loans loan eligibility rules

- Robust APIs for data integration with external and internal databases, ensuring GDPR compliance and regulatory alignment

- Automated generation of credit terms and conditions according to bank policies and partner agreements

- Elevate customer engagement with personalized mobile push notifications throughout the financing journey

- Gain holistic insights into partner activity through comprehensive 360° dashboards, covering pending CAs, disbursed loans, and rejected CAs

- Harness the power of ACP Embedded Loans to store CAS data for generating insightful reports, facilitating scoring, and identifying cross-selling opportunities

ACP Embedded Loans is trusted by

Embedded Finance

FAQ

Embedded financing also known as embedded lending specifically refers to the integration of lending services into non-financial platforms or applications. It focuses solely on the provision of loans or credit facilities within the context of other activities or experiences.

While both peer-to-peer (P2P) lending and embedded finance fall under alternative finance, they serve distinct purposes.

P2P lending platforms connect individual borrowers with individual lenders outside traditional banks, whereas embedded finance seamlessly integrates financial services into non-financial products or platforms. Thus, while both involve financial transactions, they operate differently within their respective contexts.

P2P lending platforms connect individual borrowers with individual lenders outside traditional banks, whereas embedded finance seamlessly integrates financial services into non-financial products or platforms. Thus, while both involve financial transactions, they operate differently within their respective contexts.

Automating lending services within non-financial platforms, requires careful planning, innovative solutions, and collaboration between financial and non-financial entities.

Challenges in automating embedded lending include integration complexity, accessing and analyzing diverse data sources, ensuring regulatory compliance across jurisdictions, building customer trust and education, developing accurate credit risk models, addressing fraud and security risks, and ensuring scalability.

Challenges in automating embedded lending include integration complexity, accessing and analyzing diverse data sources, ensuring regulatory compliance across jurisdictions, building customer trust and education, developing accurate credit risk models, addressing fraud and security risks, and ensuring scalability.

Ready to further explore digital lending software ACP

REACH OUT TO OUR EXPERTSEmpowering Digital Lending

Get all resources your need !

All Resources