SOLUTIONS

ACP ISLAMIC BANKING

Unparalleled adaptability and customization tailored to Islamic lending standards

Navigating the complexities of Islamic finance compliance poses considerable challenges for bankers. ACP Islamic Banking offers an all-encompassing, fully Sharia-compliant platform, empowering Islamic financing endeavors with a cutting-edge digital lending solution. With endless customization capabilities, lenders can ensure smooth lending processes that adhere strictly to Islamic banking standards.

Request an ACP Islamic Banking solution demo

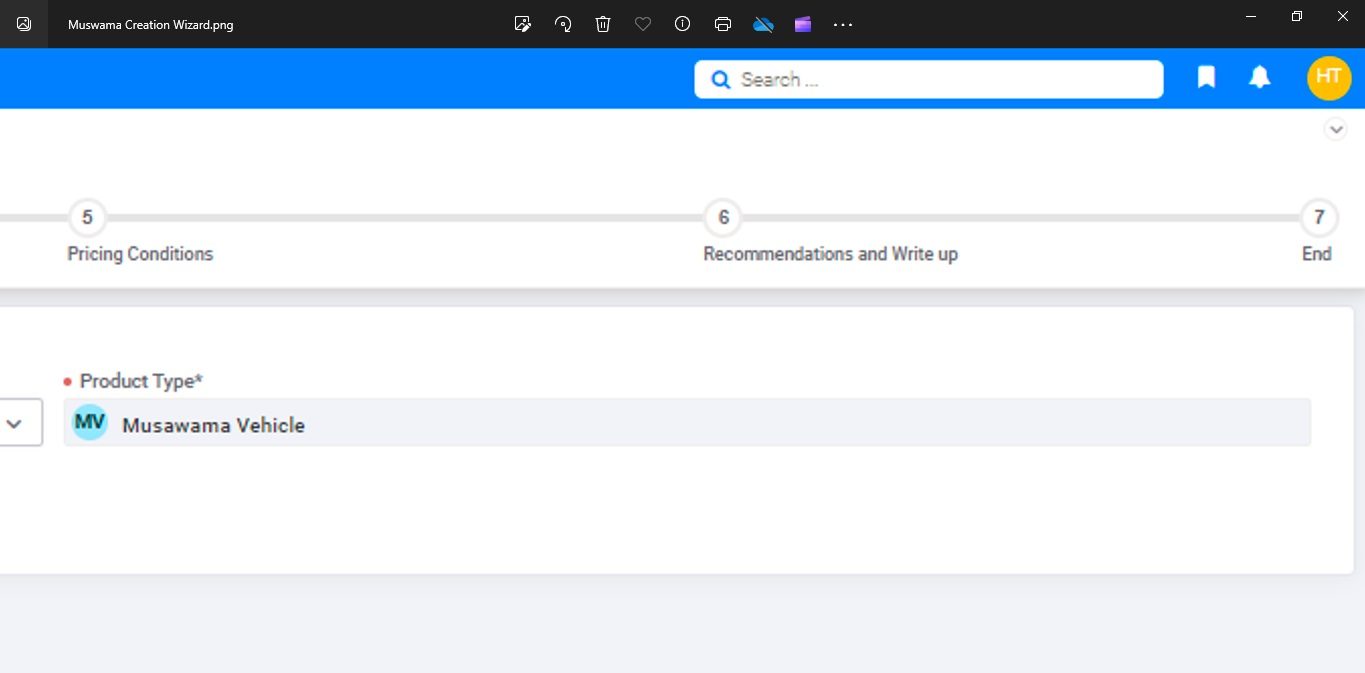

Axe Credit Portal covers all types of Islamic finance.

Ijarah

Murabaha

Tawarruq

Mudarabah

Musharakah

Istisna’a

Qard al-Hasan

Empowering a future-proof Sharia-compliant Islamic banking

An integrated solution for a holistic Islamic banking experience.

- Omnichannel customer experience through multiple channels

- AI-powered onboarding (ID recognition, OCR extraction)

- Automated credit initiation and follow-up processes

- Sharia Compliance verifications

- Halal Income Assessment

- Ethical screening

- Real-time data integration with external and internal data sources

- Enhanced decision-making quality through integrated new data sources (Adverse media…)

- Innovative ML-based scoring models

- Customizable scoring template based on Halal income score, Sharia-compliant and ethical behavior

- Internal rating scale or customized scoring model via integration

- Tracking & monitoring: collaterals, covenants, conditions, and internal risk trigger

- Ensured compliance with Islamic banking policies, GDPR international Islamic directives

- All Islamic banking products, classifications, structures, and hierarchies are fully supported

- Document processing in adherence to bank templates for various Islamic products

- Complete documentation workflows

- Generate comprehensive regulatory reporting

- Ensure detailed audit trails

- Data model flexibility and evolution

- Granular customization options under Islamic banking guidelines.

ACP Islamic Banking is trusted by

Islamic Banking

FAQs

Also known as Islamic finance or sharia-compliant banking, Islamic Banking operates according to the principles of Islamic law (Sharia) and prohibits the payment or receipt of interest (riba). Instead of traditional interest-based lending, Islamic banking follows ethical and religious guidelines that promote fairness, transparency, and social responsibility. It continues to grow as a significant segment of the global banking industry, serving both Muslim and non-Muslim customers who seek ethical and socially responsible financial solutions.

Automation streamlines Sharia-compliant financing processes such as Mudarabah and Musharakah by digitizing documentation, automating contract creation, facilitating real-time profit-sharing calculations, and ensuring compliance with Sharia principles throughout the transaction lifecycle.

Implementing automation in Islamic banking faces challenges such as ensuring Sharia compliance. Ensuring that automated processes adhere to Sharia principles can be complex, as Islamic banking transactions must comply with religious guidelines. Developing Sharia-compliant algorithms and ensuring continuous oversight by Sharia scholars is essential.

Ready to further explore our ACP lslamic Lending software

REACH OUT TO OUR EXPERTSEmpowering Digital Lending

Get all resources your need !

All Resources