Global banks managing multiple entities face fragmented credit processes across different countries, policies, languages, and currencies. Inconsistent credit standards, redundant approvals, and compliance misalignment slow decision-making and increase credit risk.

ACP Multi-entity Lending streamlines operations by standardizing processes across subsidiaries, branches, and business units—while adapting to local market needs. It enhances efficiency, ensures regulatory compliance, and enables faster, smarter lending decisions at a scale. Additionally, it improves HQ-level monitoring, providing better oversight and risk control across all lending entities

Request a demo of ACP Multi-Entity Lending

Flexible digital lending: Unifying data and processes across multi-entity environments

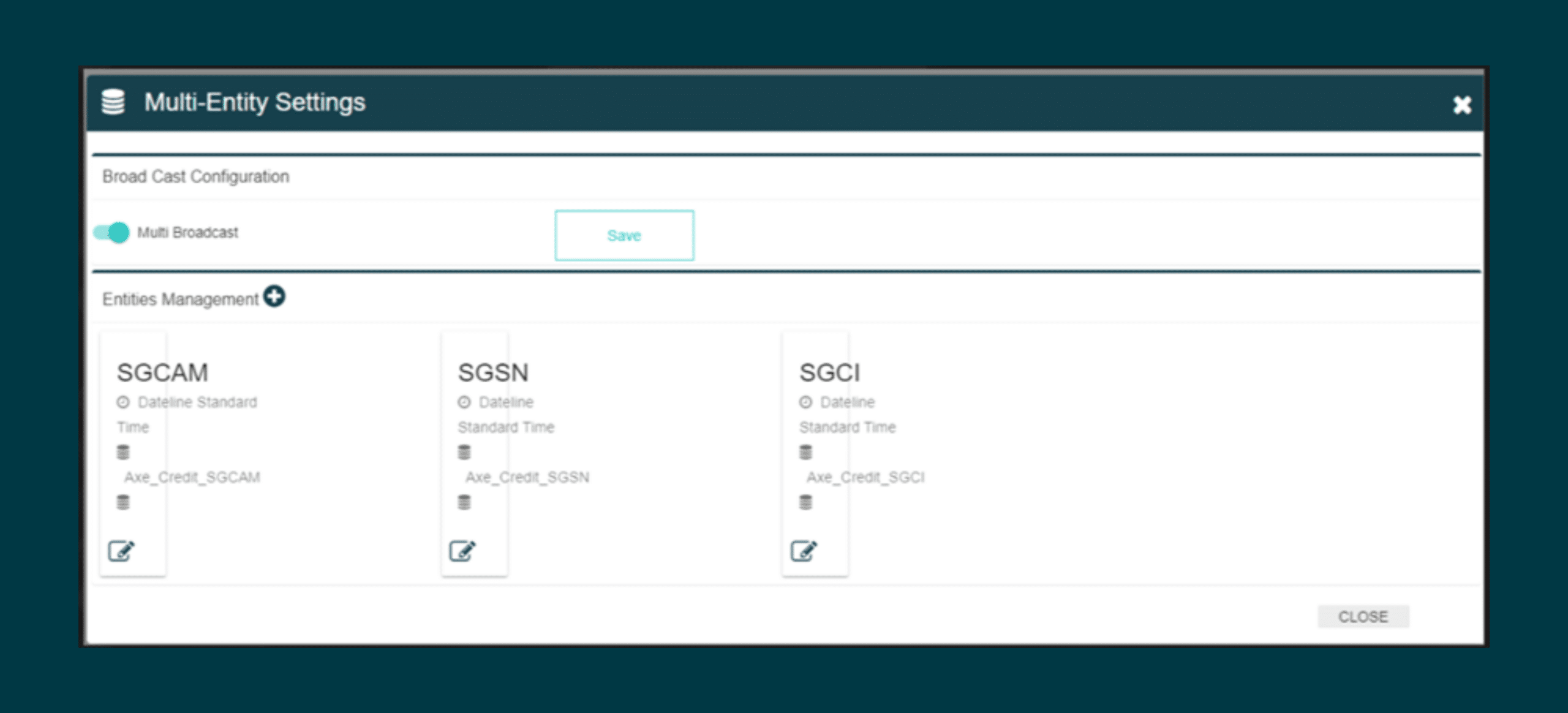

1/ Centralized and decentralized entity management

2/ Multi-currency and multi-language support

3/ AI-powered automation for credit processing

4/ Real-time, entity-specific credit decisioning

5/ Cross-entity compliance and data security

6/ Hybrid and multi-cloud deployment

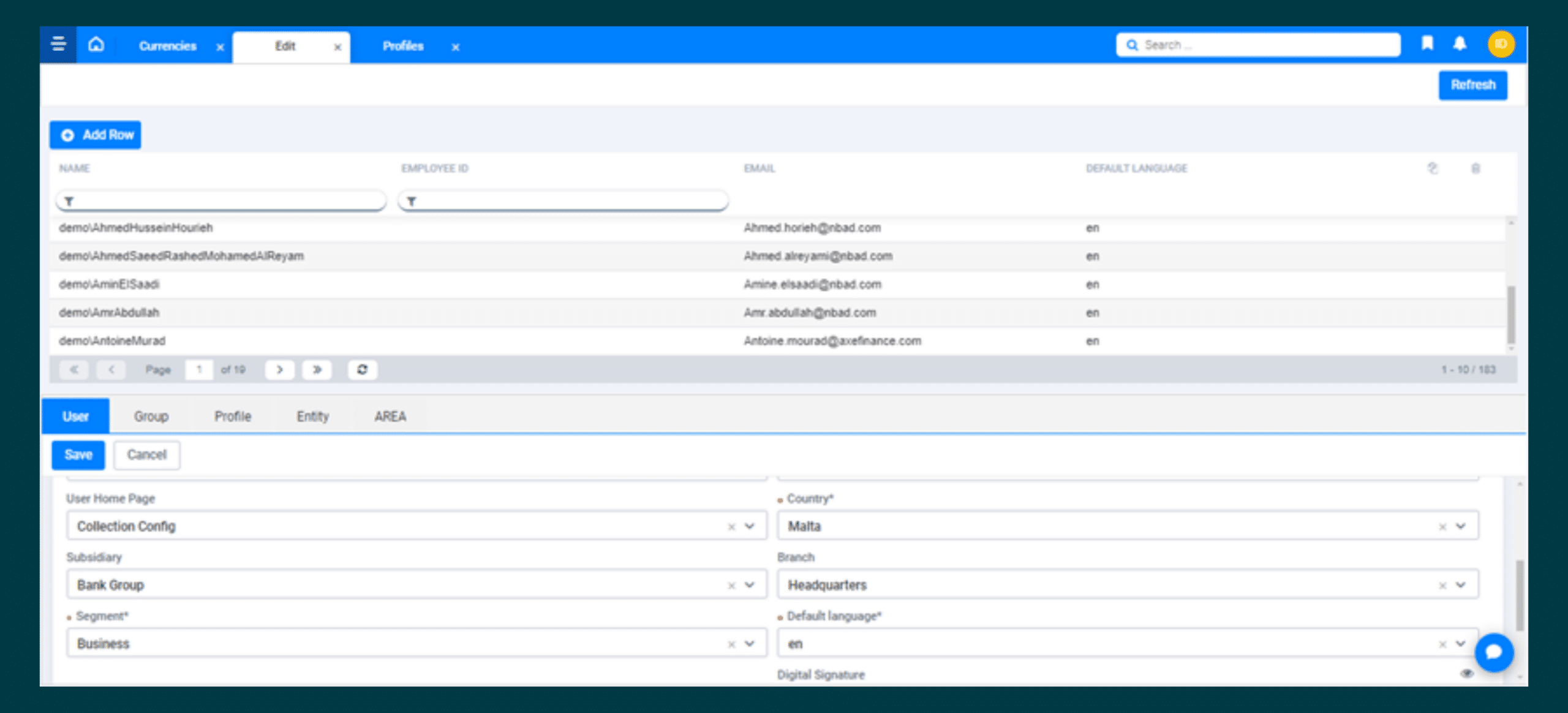

7/ Role-based access control with global vs. local admin profiles

8/ Real-time consolidated reporting and analytics

9/ AI-based multi-entity risk monitoring

Experience next-level digital lending with ACP's Multi-Entity capabilities

Achieve operational efficiency and elevate customer experience with ACP Multi-Entity Lending

- AI-enhanced borrower onboarding and KYC: simplifies and standardizes onboarding across entities

- Automated customer data synchronization: ensures accurate, up-to-date data across branches and subsidiaries

- Intelligent credit application processing: adapts to different entity requirements

- Multi-entity cross-selling: enables relationship managers to identify and act on cross-entity opportunities

- Cross-entity credit application support: allows group-wide applications with coordinated processing

- Unified financial template management: standardizes document collection and analysis across jurisdictions

- Entity-specific risk models: customizes risk assessments for each entity

- Automated data extraction: ensures accuracy and timeliness of financial data across entities

- Integrated risk data sources: combines internal and external data for a complete risk profile

- Real-time credit decisioning: enables fast, entity-specific decisions

- AI-driven predictive analytics: improves forecasting across entities

- Credit scoring unification: centralizes credit scoring for consistency across business units

- Support for cross-entity counterparty structure management: enables full visibility over group-level exposures

- Anomaly detection across counterparty structures: flags irregularities in corporate hierarchies and relationships

- AI-powered early warning systems: detect emerging risks across multiple entities

- Automated risk monitoring: tracks risk indicators in real time

- Anomaly detection and delinquency alerts: identifies issues early for proactive risk management

- NLP-driven risk analysis: leverages adverse media and unstructured data sources

- Pattern recognition for early risk detection: uncovers risk trends across portfolios

- Data-driven portfolio management: enables better decision-making and performance tracking

- Collections optimization: enhances efficiency while ensuring compliance across jurisdictions

- Global search capabilities: find clients, portfolios, and documents across all entities instantly

- Unified repayment tracking: manage repayment schedules and adjustments across entities

- Automated interest and fee calculation: ensures accuracy and consistency across subsidiaries

- Centralized communication with borrowers: delivers a consistent experience across branches

- Flexible loan restructuring: supports tailored solutions for complex group clients

- Unified repayment visibility across counterparty structures: full transparency on group exposures

- Cross-entity chat functionality: facilitates internal collaboration and speeds up operations

- Multi-entity performance tracking: visualize credit performance across business units

- AI-powered loan portfolio forecasting: anticipate trends and manage risk proactively

- Regulatory and internal reporting: automate compliance reporting across jurisdictions

- Multi-currency & multi-language support: seamless operation across diverse regions

- Scalable cloud deployment: adaptable to hybrid and multi-cloud infrastructures

- AI-powered automation: reduces manual workload across credit operations

- Zero-code embedded configuration tool (Axe Studio): enables unlimited customization in total self-sufficiency

- Global vs. local administrator profiles: tailored access and control for better governance

Axe Credit Portal is trusted by

ACP Multi-Entity Lending

FAQs

As banks expand across regions, subsidiaries, and business units, managing credit processes uniformly becomes more complex. Multi-entity lending enables institutions to centralize oversight while respecting local regulations, customer needs, and operational nuances—ensuring consistency, efficiency, and compliance across the board.

ACP leverages AI and integrated data sources to offer comprehensive multi-entity credit risk management. It features entity-specific scoring models, cross-entity risk assessments, automated data extraction, and real-time credit decisioning. With tools like predictive analytics, early warning systems, and anomaly detection, banks gain a 360° view of group-level exposures and can proactively manage portfolio risk across jurisdictions.

Absolutely. ACP offers a zero-code configuration tool (Axe Studio), allowing institutions to tailor workflows, rules, user interfaces, and documents to meet specific market and regulatory needs—without relying on IT resources. Its support for centralized and decentralized governance, combined with scalable cloud deployment and multi-language/multi-currency functionality, ensures flexibility across diverse regions and business models.

Ready to further explore ACP Multi-Entity lending solution?

REACH OUT TO OUR EXPERTSEmpowering.

Digital.

Lending.

Get all resources your need !

All Resources