Solution by use case

ACP Credit approval

ACP Credit approval

& Underwriting Solution

Speed up credit analysis and decisioning while mitigating risk

Manual underwriting processes, lengthy approval procedures, and frequent document requests often cause customer frustration. Without the ability to utilize advanced analytics and data modeling techniques for deeper insights into credit applicants, inconsistent decision-making across underwriters or branches may occur, resulting in disparities in loan approvals and potential bias.

ACP approval and underwriting solution helps lenders automate and streamline the approval and underwriting process, improve decision-making accuracy, and enhance risk management capabilities, ultimately leading to faster loan approvals and improved customer satisfaction.

Request an ACP approval solution demo

1/ Data collection, validation, & verification

Ensuring the accuracy and completeness of credit data collected.

2/ Credit Data analysis

Traditional and AI-powered creditworthiness assessment of the borrower.

3/ Credit Risk assessment

Assessment of risk ratios including the probability of default (PD), debt service coverage ratio (DSCR), loan-to-value ratio (LTV), and debt-to-income ratio (DTI).

4/ Automated decision-making

Automatic decisioning recommendation based on predefined rules, models, and risk thresholds as per the lender credit policy.

5/ Underwriting process

The final decision is made based on tthe scoring, the borrower creditworthiness, and authority delegation.

6/ Final approval & credit administration

Determining loan terms and advancing the application to the next stage.

ACP efficient underwriting and seamless approvals

Accelerate your approval and underwriting process, ensuring swift decisions while safeguarding against risks

- Automatic verification of documents, cross-referencing information with external databases, and conducting background checks

- Enhanced document verification leveraging Optical Character Recognition (OCR) technology for accuracy and efficiency

- Automated verification protocols to efficiently collect and authenticate required identification documents and information

- Seamless data analysis based on factors such as credit history, debt-to-income ratio, payment history, credit utilization, and other relevant metrics

- Rule-based and AI-powered scoring models for a more accurate insight into the credit application

- Powerful APIs support real-time data integration with external sources such as credit bureaus, financial institutions, and alternative data providers.

- Employs ML models to assess credit risk accurately, analyzing various factors such as credit history, income, debt-to-income ratio, and collateral value

- Reduced workload thanks to automatic approval and rejections with ACP Scoring

-

Increased focus on credit applications that require further risk analysis and human assessment

-

Continuously fine-tune risk policies and tweak model parameters

-

Produce and deploy high-performing AI-based scoring models

-

Integrates seamlessly with external data sources, such as credit bureaus, to access comprehensive customer information and enhance decision-making accuracy

- Streamline underwriting with workflow automation capabilities, freeing bankers from repetitive tasks.

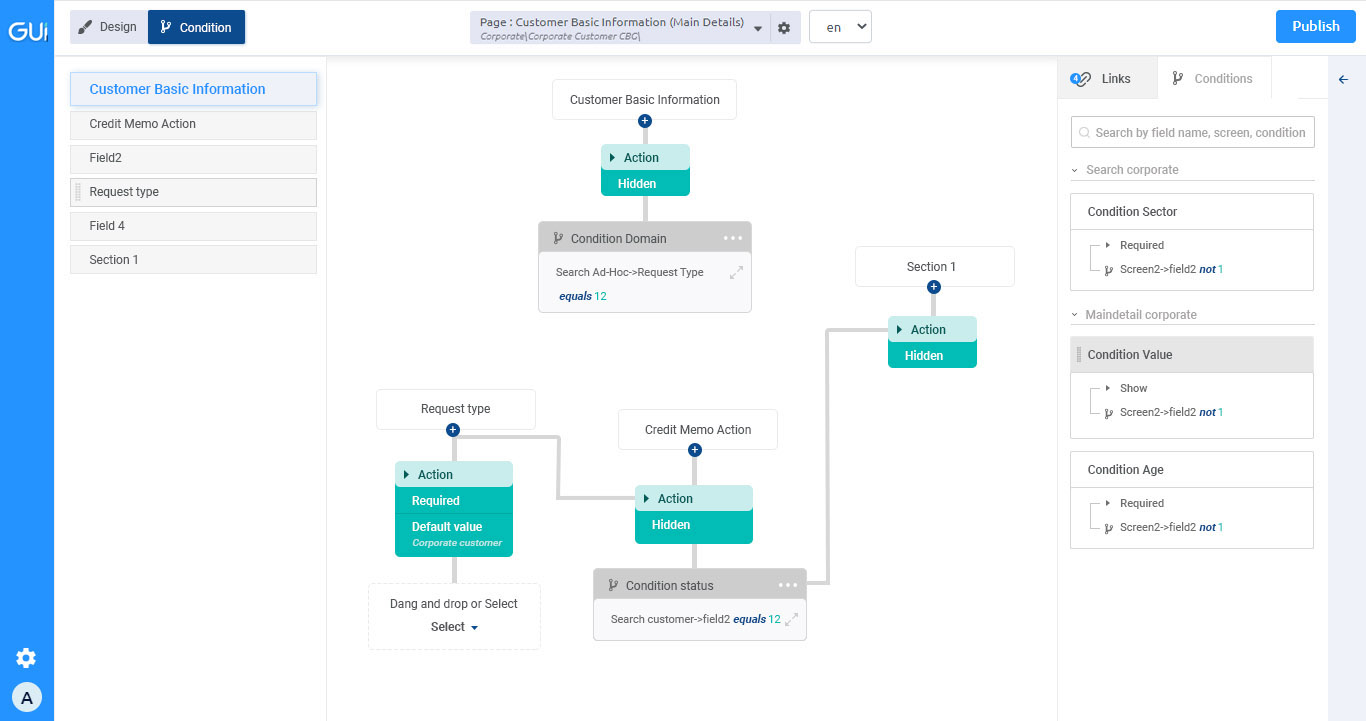

- Tailor underwriting criteria using a customizable rules engine to align with risk appetite, lending policies, and regulatory demands.

- Instantly generate loan agreements post-approval for swift finalization.

- Employ AI to monitor borrower credit performance, leveraging Early Warning Signals (EWS) for insights.

- Securely organize and store applicant documentation with a seamless document management system.

ACP Loan approval and underwriting solution is trusted by

Loan underwriting and approval

FAQ

Loan origination softwares, such as Axe Credit Portal (ACP), is a digital platform designed to automate and streamline the lending process for banks and financial institutions. ACP facilitates end-to-end loan origination, from KYC, approval, scoring and decisioning and up to servicing, enhancing operational efficiency and improving borrower satisfaction.

The configuration tools are designed to ensure robust regulatory compliance through a combination of built-in checks and customizable workflows tailored to meet regulatory standards. It automates the generation of documentation for loan agreements and disclosures, guaranteeing adherence to regulatory requirements. Additionally, the tool seamlessly integrates with external regulatory databases, providing real-time updates on compliance requirements to users. With tracking and audit trail features, it enables continuous monitoring of compliance with regulatory changes over time. Furthermore, the tool undergoes regular updates and maintenance to keep pace with evolving regulatory landscapes, ensuring that users remain compliant at all times

Yes, the configuration tool is designed with seamless integration in mind, allowing it to easily connect with the bank’s existing systems and processes. Whether with legacy software or modern platforms, the tool offers flexible integration options to ensure smooth interoperability. By leveraging industry-standard protocols and APIs, it enables efficient data exchange and synchronization, minimizing disruptions to your operations.

Ready to further explore digital lending software ACP

REACH OUT TO OUR EXPERTS

Get all resources your need !

All Resources