Solutions

ACP BI & Reporting

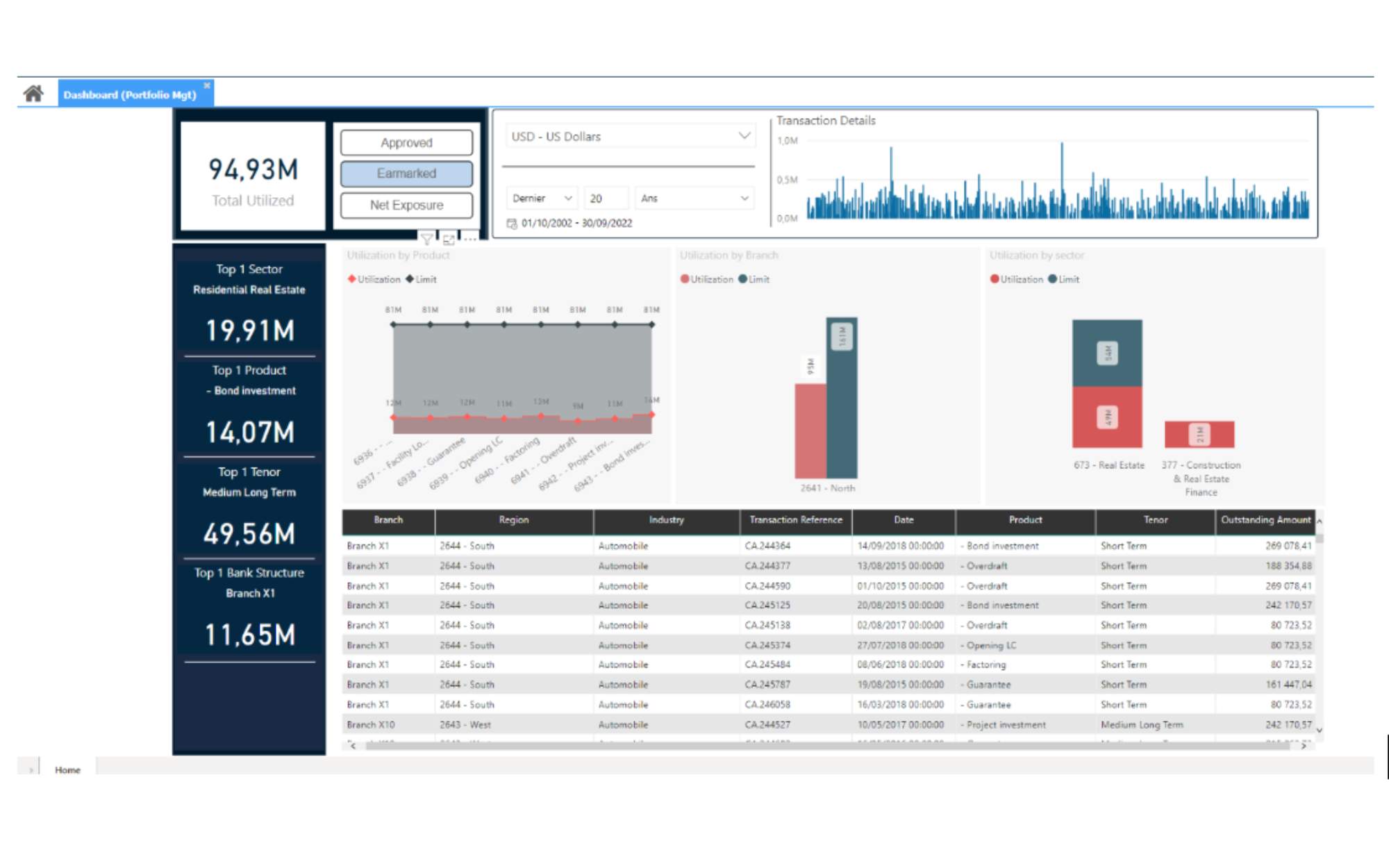

Leveraging innovative BI for customized dashboards and data-driven lending strategies

Handling vast amounts of data from diverse sources while ensuring accuracy, completeness, and consistency poses a significant challenge, particularly with legacy systems. As data volumes increase, scalability and accurate analysis of complex datasets become even more critical.

ACP's Business Intelligence (BI) and Reporting solution addresses these challenges with robust data analytics, intuitive visualization tools, real-time insights, and scalable architecture, empowering bankers to make informed credit decisions, optimize loan portfolios, and elevate the customer experience.

Request a demo of ACP BI & Reporting

ACP's Business Intelligence (BI) and Reporting solution addresses these challenges with robust data analytics, intuitive visualization tools, real-time insights, and scalable architecture, empowering bankers to make informed credit decisions, optimize loan portfolios, and elevate the customer experience.

Elevate your digital lending with accurate data insights and powerful analytics

Decision Support

Analysis of historical data, identify trends, and forecast future performance

Deeper customer understanding

Customer segmentation, profiling, and predictive analytics

Operational Efficiency

Analysis of operational data to streamline processes

Risk Management

Monitoring of various types of Ratio risks

Lending Performance Monitoring

Real-time visibility into key performance indicators (KPIs)

Regulatory Compliance

Ensured compliance with alerts and notifications on compliance reports

Navigate data complexity flawlessly with ACP BI & Reporting solution

Empowering credit decisions and mitigating risks with precise and accurate KPI reportings

- Advanced portfolio analysis features and powerful business intelligence modules.

- Real-time data integration with external and internal data sources.

- Move from intermittent and limited scope checking to regular and wide-range portfolio monitoring.

- Holistic screening and categorization of the credit portfolio.

- °360 dashboards of client activities and dynamic reports building.

- Compare real observations vs AI-based decisions thanks to advanced dashboards and charts provided to monitor the models.

- Compelling dashboards reflecting portfolio health, warnings history, as well as delinquency forecast with most risky exposures, while allowing to trigger action plan workflows.

- Dashboards and dynamic reports building.

- High level of data coherence and integrity.

- Changes in customer behavior patterns are carefully tracked, reported, and assigned appropriate severities to improve delinquency prediction accuracy.

- Extension of credit to deserving applicants who would have been denied a loan using previous methods.

- Automate knowledge extraction and analysis through state-of-the-art techniques such as Natural Language Processing (NLP), Predictive Analytics, Big Data Mining, and Clustering.

- New analytical perspectives based on customer performance and interactions are available.

Axe Credit Portal is trusted by

BI & Reporting

FAQ

Business Intelligence (BI) in the context of a digital lending solution refers to the use of data analysis tools and techniques to gather, store, analyze, and visualize data related to lending operations. BI enables financial institutions to gain insights into various aspects of their lending activities, including customer behavior, credit risk assessment, loan performance, and operational efficiency. By leveraging BI, banks can make informed decisions, optimize lending processes, mitigate risks, and enhance customer satisfaction.

BI helps lenders make informed decisions by providing actionable insights into customer behavior, credit risk, market trends, and operational performance. By leveraging BI, lenders can enhance decision-making processes, optimize lending strategies, and improve overall business performance. Additionally, BI enables lenders to monitor key performance indicators, ensure regulatory compliance, and adapt to changing market conditions more effectively. Overall, BI plays a crucial role in empowering lenders with the tools and insights needed to thrive in today's competitive lending landscape.

It starts with defining objectives aligned with business goals, assessing data needs, and collecting and integrating data from various sources. This process involves selecting appropriate BI tools, developing customized dashboards and reports, and implementing analytical models to extract actionable insights. ACP BI provides banks with standardized dashboards while also allowing for the easy creation of customized KPI dashboards, enabling them to harness the power of BI to improve decision-making and drive operational efficiency in lending operations.

Ready to further explore digital lending software ACP

REACH OUT TO OUR EXPERTS

Get all resources your need !

All Resources