High market volatility emphasizes the need for bankers to effectively monitor credit risk exposure and optimize collateral inventories.

ACP Collateral management solution automates the collateral process starting from the credit initiation all the way through valuation (initial and subsequent), documentation, perfection, deferrals, LTV monitoring, release and disposal in the event of default. The complexities of collateral management are managed efficiently thanks to advanced business rules and flexible workflows,

Request a demo of ACP Collateral Management

Future-proof your collateral management automation for optimal risk mitigation

1/ Collateral Identification

2/ Data Capture and Validation

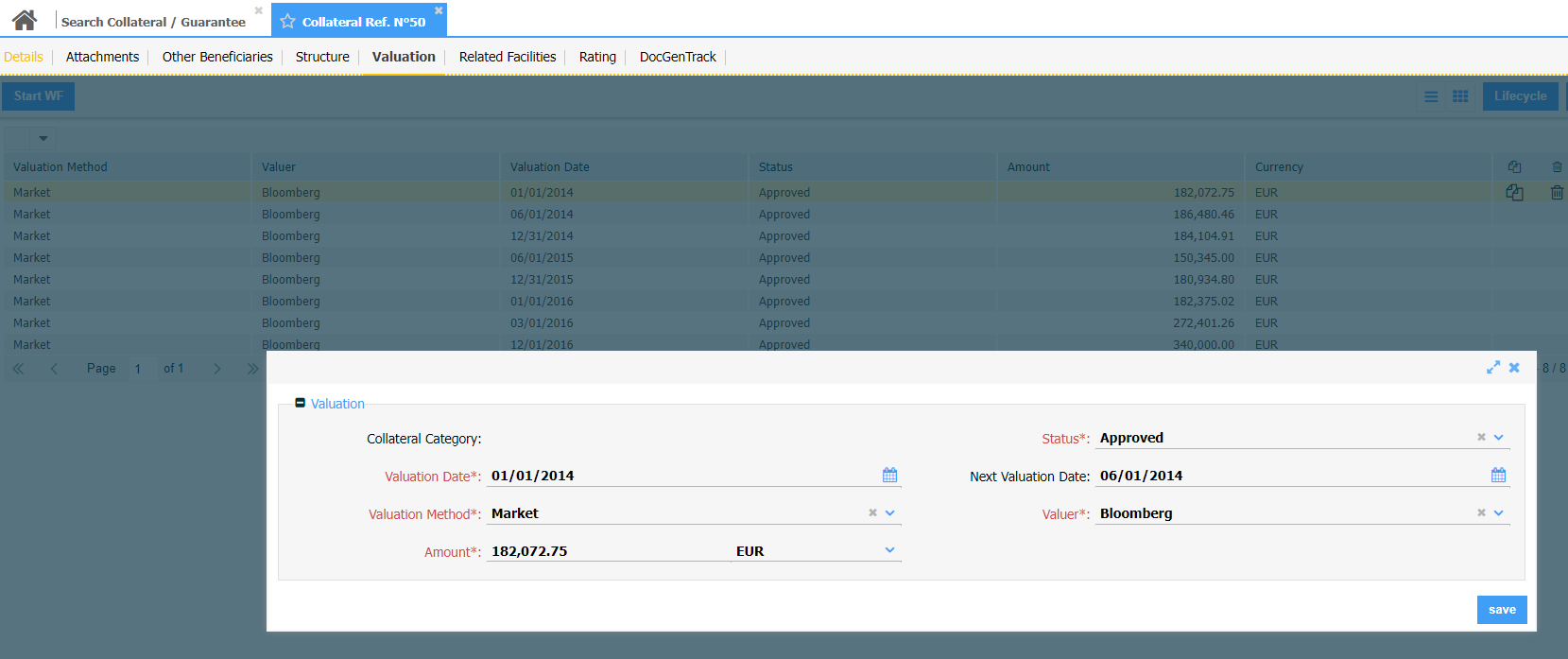

3/ Collateral Valuation

4/ Monitoring and Maintenance:

5/ Reporting and Compliance

6/ Release or Liquidation

A unified and seamless approach to collateral management

Comprehensive automation of your collateral management

-

Granular collateral capture

-

Flexible allocation and ranking

-

Streamlined appraisal and monitoring

-

Diverse collateral handling

-

Historical valuation storage

-

Collateral reuse and eligibility rules

-

Financial collateral security

-

Handling multiple valuation methods

- Consistent collateral documentation.

- Monitor LTV and trends, and adjust margin as needed.

- Apply appropriate haircuts at the granular or category level.

- Monitor collateral concentration across the portfolio.

- React quickly to market movements.

- Monitor collateral portfolio liquidity.

- Monitoring reports and alerts/ticklers through various channels.

- Proactive monitoring and tracing of collateral waivers, releases, and deferrals.

- Automated Collateral portfolio revaluation tools.

- Dynamic calculation of collateral availability,

- Partial/total release workflows

- Insurance schedules, alerts, messaging, and remedial workflows.

- Enforce standardized processes in collateral management.

- Complete documentation workflows.

- Maintain collateral checklists and eligibility rules.

- Apply regulatory haircuts.

- Generate your regulatory reporting.

- Consistent and quality collateral data for risk systems.

- Utilize historical data for EAD/LGD calibration.

- Ensure detailed audit trails.

- Regulatory collateral classification.

- Data model flexibility and evolution.

- Optimize capital calculations with improved collateral assignment.

- Document tracking and compliance with internal policies and regulations.

Axe Credit Portal is trusted by

Ready to further explore ACP Collateral Management Solution

REACH OUT TO OUR EXPERTSEmpowering.

Digital.

Lending.

Get all resources your need !

All Resources