Solutions

ACP Collection & Provisioning

Effortlessly streamline asset security and regulatory compliance

Lenders seek a proactive approach to enhance credit portfolio quality, anticipate delinquencies, and formulate optimal debt recovery plans.

ACP Collection & Provisioning, leveraging AI, empowers lenders to efficiently address debt recovery efficiency and accurately calculate provisions across various segments.

Request a demo of ACP Collection & Provisioning

Enhanced recovery efficiency and loss mitigation

1/ Early detection & Communication

Automated reminders via email or SMS for missed payments or any changes in behavior, utilizing Early Warning Systems (EWS)

2/ Assessment and Negotiation

Repayment plan or alternative remedial on loan terms, extending the repayment period, reduced payment amount.

3/ Follow-up communication

Automated follow-up messages, upcoming payments, negotiated repayment plans.

4/ Escalation

Automated escalation triggering collection (the number of missed payments or the total overdue amount),

5/ Enforcement

Automated legalprocesses (electronic documentation and submission of legal notices, demand letters, or court filings)

6/ Resolution and closure

Digital records upon successful resolution, with notifications sent to borrowers confirming closure of the debt recovery case.

An innovative solution for loan collection and provision calculation

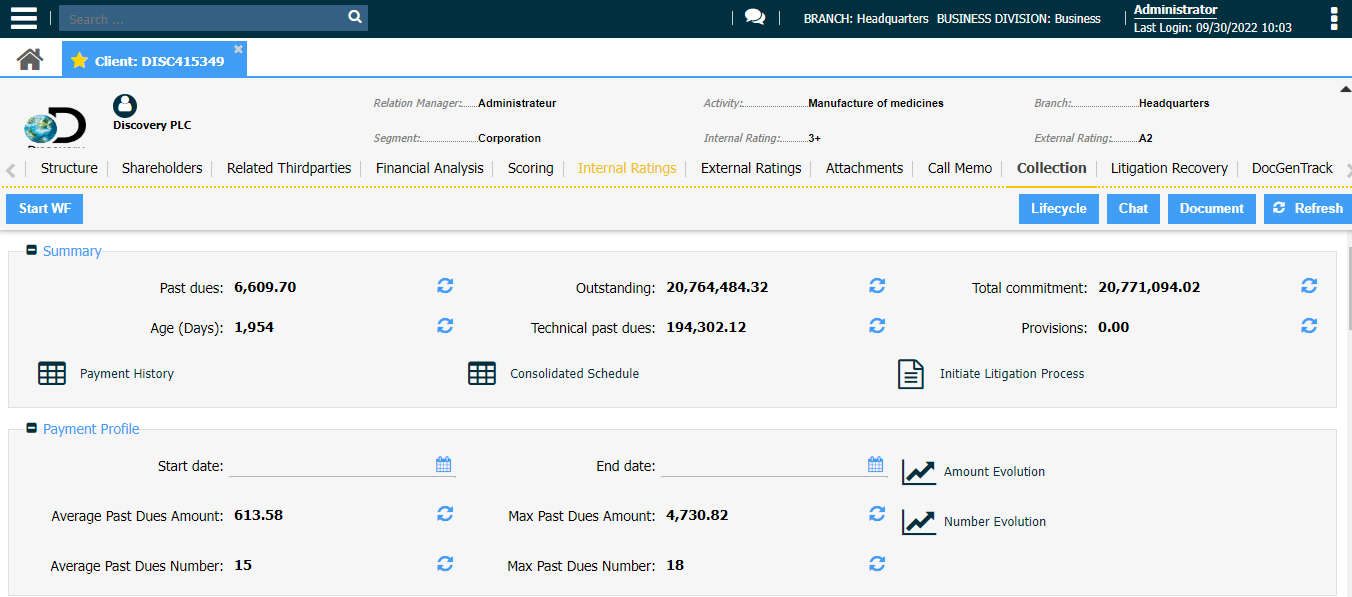

Maximize your collection effectiveness while improving your time to recovery

- Follow up and manage triggered credit events via dedicated and fully configurable workflows.

- Customize various workflows according to “type of client”, “history”, “track record”, “amount past due”, circumstances such as first recovery, second, “first notice”, “escalation level”, “amount to recover”, etc.

- Perform portfolio aging and bucketing.

- Workflow-driven communication provides a better experience for borrowers leading to improved debt recovery.

- Identify and record changes in credit quality since origination

- Calculate general and specific provisions for performing, doubtful and impaired assets as per internal, group or IFRS9 rules

- Classify assets: stage 1, 2 and 3

- Integrate NPL data either manually within ACP or extracted from Core Banking or any other source system

- Host models and capture all inputs required for calculating ECL (Expected Credit Loss) and provisions: PD (12-month and Lifetime), LGD, Outstanding, CCF

- Closely monitor client credit worthiness trend and identify any increase in credit risk

- Benefit from your collateral portfolio quality when calculating your provisions

- Compare internal/group provisions vs. IFRS 9 calculations

Axe Credit Portal digital lending solution is trusted by

Ready to further explore ACP Collection and provisioning

REACH OUT TO OUR EXPERTSEmpowering.

Digital.

Lending.

Get all resources your need !

All Resources