Solutions

ACP Early Warning Systems (EWS)

From a reactive to a proactive approach for credit portfolio monitoring

Late detection of deteriorating credit worthiness leads to fewer mitigation options and potential losses. ACP Early Warning System (EWS) offers both the established models of traditional EWS and the diverse data sources of AI-powered EWS to produce proactive predictive capabilities.

Request a demo of ACP Early Warning System

Empowering timely detection of delinquent loans for proactive remediation

1/ Data collection & integration

Extract, transform, huge volume of structured and unstructured data (transactional, credit , financial statements, and customer information).

2/ Feature Engineering

Advanced techniques to create new variables key variables or features (payment history, debt-to-income ratio, and customer demographics).

3/ Models & pattern detection

Include all customer data, account activity, ATM transactions, and any tracked interactions to identify, track, and report changes in customer behavior patterns.

4/ Threshold setting

Determine threshold values for each predictive model to classify loans into different risk categories, such as low risk, moderate risk, or high risk.

5/ Monitoring and integrated alerts

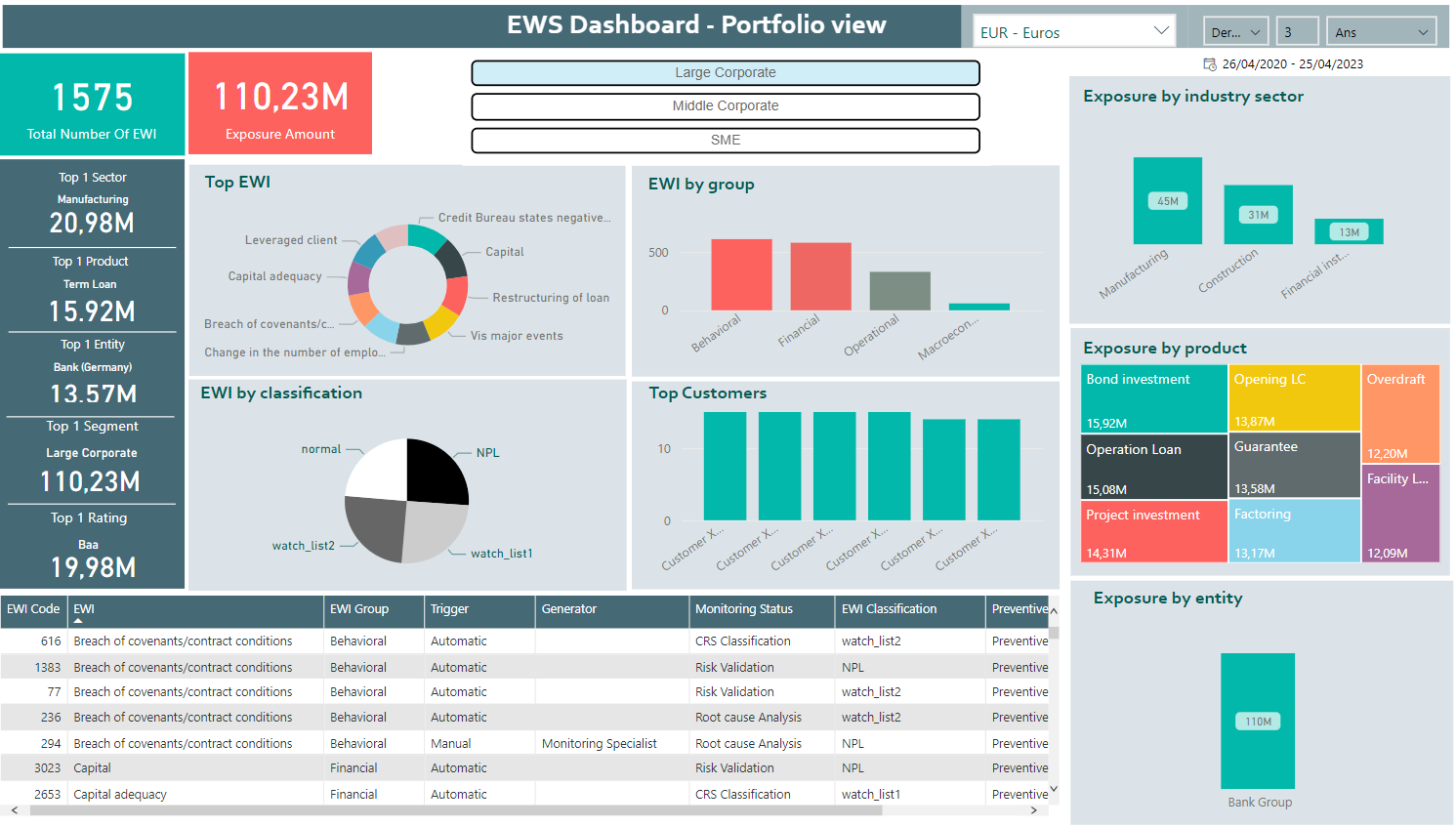

Dashboards reflecting portfolio health and forecasting delinquency. Remediation workflows can be initiated when loans exhibit EWS or breach predefined thresholds.

6/ Automated remerdial action

Develop actionable workflows for addressing identified risks, including early borrower intervention, loan restructuring, and collection initiatives.

Leveraging traditional and AI-powered EWS for timely detection of delinquent loans

Moving from a reactive to a proactive portfolio monitoring approach

- Automate knowledge extraction and analysis through state-of-the-art techniques such as Natural Language Processing (NLP), Predictive Analytics, Big Data Mining, and Clustering.

- New analytical perspectives based on customer performance and interactions are available

- Changes in customer behavior patterns are carefully tracked, reported, and assigned appropriate severities to improve delinquency prediction accuracy

- Move from an intermittent and limited scope checking to a regular and wide range portfolio monitoring

- Benefit from a holistic screening and categorization of the credit portfolio.

- Compelling dashboards reflecting portfolio health, and warnings history.

- Delinquency forecast with the most risky exposures.

- Trigger action plan workflows.

- Build and customize robust and performing Machine Learning pipelines.

- Support tech-savvy business experts in the ingestion and processing of structured and unstructured data.

- Produce and deploy high-performing AI-Powered Early Warning Signals models.

- Monitor internal & external data quality.

- Algorithms are fine-tuned over time and increasingly acquire a high level and measurable accuracy.

Axe Credit Portal is trusted by

Ready to further explore ACP Early Warning System

REACH OUT TO OUR EXPERTSEmpowering.

Digital.

Lending.

Get all resources your need !

All Resources