ACP ESG Solution

A cutting-edge and flexible solution for smart green loans and enhanced ESG performance

ACP ESG is an automated solution that integrates Environmental, Social, and Governance (ESG) criteria into the loan origination process, with AI capabilities to enhance data collection and analysis. This platform supports a comprehensive, automated assessment of ESG factors, ensuring alignment with sustainable practices throughout the credit lifecycle. Featuring robust customization options and a user-friendly interface, it improves decision-making efficiency, compliance, and customer satisfaction while integrating ESG into the bank’s lending strategies.

Leveraging cutting-edge ESG tools for sustainable lending practices

Enhancing loan origination with automated ESG scoring solution

Empowering the future of sustainable banking with ESG credit analysis

-

Seamless integration of ESG factors at each stage of the loan origination process.

-

Immediate communication of ESG scores to customers and internal stakeholders across multiple channels.

-

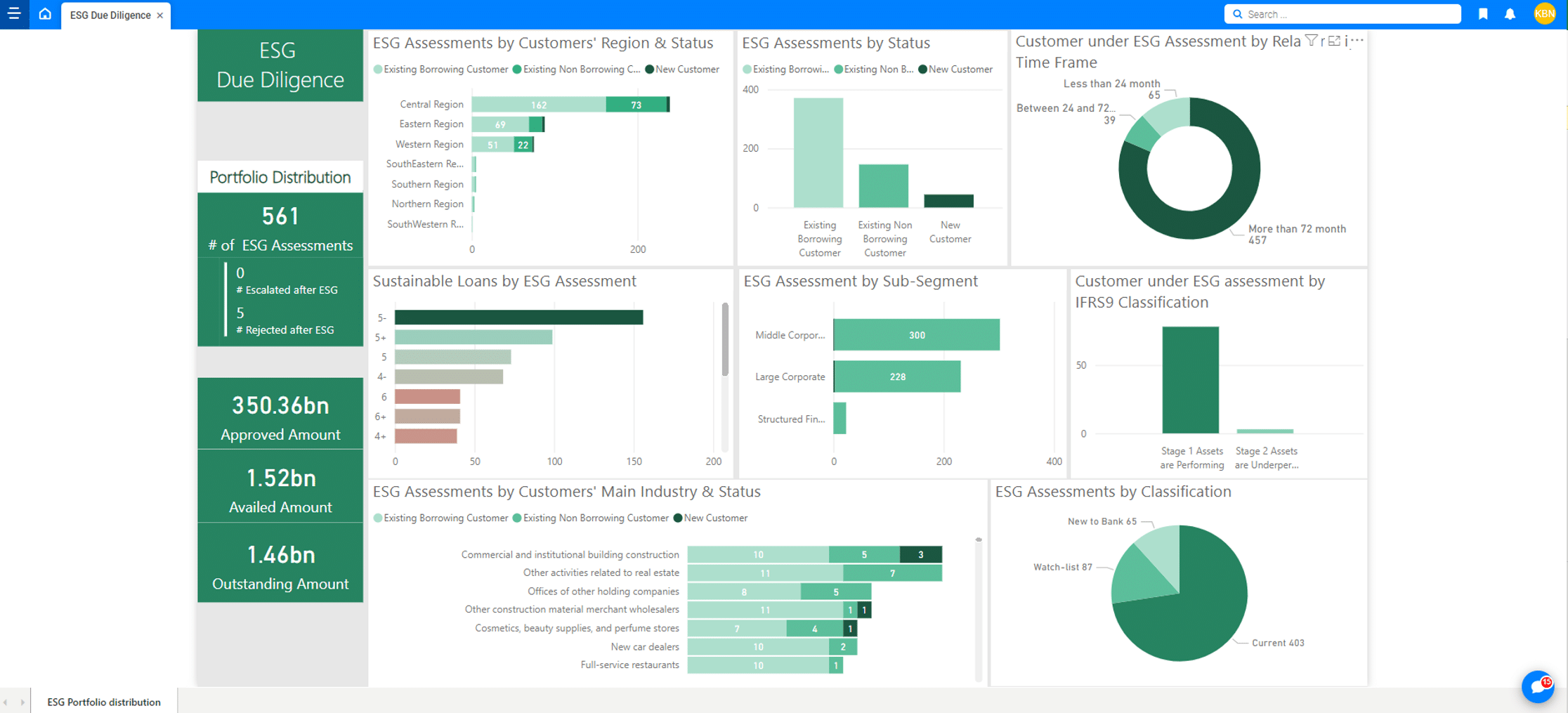

Customizable dashboards to monitor ESG performance and metrics across the entire loan portfolio.

-

Automated integration and processing of ESG data for real-time updates and score calculations.

-

Effective monitoring of loan risk and eligibility by generating and recording ESG scores for each application.

-

Real-time synchronization between core banking systems and the ESG scoring engine.

-

Proactive risk management and anticipation of borrower needs through daily batch processing of ESG data.

-

Configurable scoring engines tailored to local regulations and multiple ESG frameworks.

-

Full autonomy with drag-and-drop, zero-code graphical user interface configurations.

-

Improved risk mitigation and reduction of defaults through early warning signals based on ESG factors.

-

Optimized loan assessment and terms through comprehensive ESG risk analysis.

-

Accurate calculation of loan conditions and interest rates incorporating ESG scores.

-

Automated valuation of collateral and centralized management according to ESG policies.

-

Real-time, seamless customer experience across all platforms using robust APIs and omnichannel support.