Solutions

ACP KYC & Onboarding

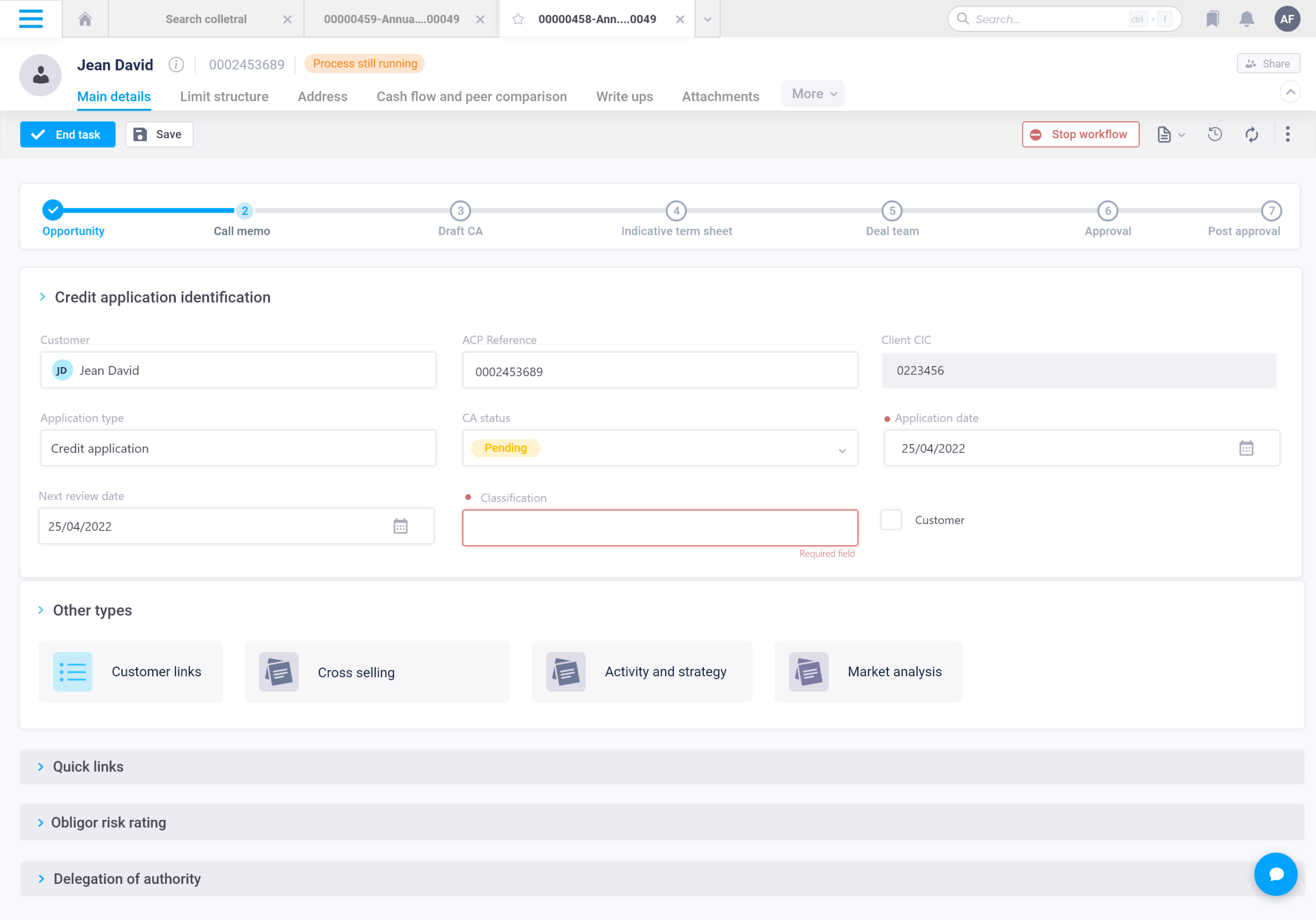

Automating the opening act of the credit journey

KYC, Onboarding, and Lead Management.

Meeting stringent KYC demands and balancing compliance with exceptional onboarding experiences are key challenges. Effective lead management maximizes conversion rates and market opportunities.

ACP Seamless automation of KYC, onboarding, and lead management propels bankers confidently through the initial credit lifecycle stages.

Request a demo of ACP KYC & Onboarding solution

ACP Seamless automation of KYC, onboarding, and lead management propels bankers confidently through the initial credit lifecycle stages.

Unlock seamless compliance with ACP eKYC capabilities where security meets simplicity

1/ Automated contact details capture

Simplify initial data collection across channels.

2/ Prospect identification & lead scoring

Target potential borrowers effectively.

3/ Automated initial contact & engagement

Promptly engage with borrowers using automated tools.

4/ Electronic KYC verification

Expedite onboarding with AI-driven identity verification.

5/ Automatic loan application triggers

Initiate applications based on eligibility criteria.

6/Automated lead nurturing & conversion

Streamline communication to accelerate application submission.

7/Streamlined onboarding workflows

Efficiently capture borrower information.

8/Risk assessment & product suitability

Use AI for accurate credit analysis.

9/ Continuous KYC monitoring & updating

Ensure compliance with regular data updates

Accelerating onboarding, streamlining KYC & lead generation

Elevate customer experience and accelerate the financing journey

- Employ advanced automation systems to identify potential leads, leveraging targeted marketing campaigns, website interactions, and referrals.

- Automatically gather lead information and evaluate their suitability for credit products based on specific lending criteria, ensuring efficient lead qualification processes.

- Initiate automated communication sequences, utilizing email, SMS, or chatbots, to engage leads and kickstart interactions with personalized messages about tailored credit products and services.

- Deliver automated messaging that highlights the benefits of available customized credit offerings, encouraging cross-selling opportunities.

- Deploy specialized automated KYC verification protocols designed for bankers to collect and authenticate necessary identification documents and information from leads.

- Utilize cutting-edge automated tools for conducting background checks (PEPs etc.) and fraud detection, ensuring adherence to stringent KYC regulations and compliance standards.

- Guide leads seamlessly through the onboarding journey using automated workflows and digital forms, simplifying account setup and verification procedures.

- Automate the collection and validation of additional information required for account setup, guaranteeing customers a smooth and hassle-free onboarding experience.

- Implement automated email sequences and CRM systems tailored to bankers to nurture leads and maintain engagement throughout the onboarding process.

- Provide automated support and assistance to leads through intelligent chatbots or automated response systems, addressing inquiries and concerns promptly and efficiently.

- Streamline the conversion process by automating the transition of qualified leads into customers through predefined workflows.

- Automatically finalize account setup and trigger origination processes, granting customers immediate access to credit facilities and comprehensive account information for enhanced convenience and satisfaction.

ACP solution trusted by

KYC & Onboarding

FAQs

In the credit lifecycle, the onboarding process refers to the steps taken to welcome and integrate new customers into the lending institution's systems and services after they have been approved for a credit product. This process typically involves verifying the customer's identity, setting up their account, and providing them with the necessary information and tools to effectively manage their credit. Onboarding may include tasks such as collecting additional documentation, explaining terms and conditions, and facilitating the first transaction or use of credit. The goal of the onboarding process is to ensure a smooth transition for the customer while mitigating risk and ensuring compliance with regulatory requirements.

Credit limits for new customers are determined based on their creditworthiness, affordability, risk appetite of the lender, the type of credit product, and the lender's internal credit policies. Factors such as credit score, income, employment status, and debt levels influence the decision.

The onboarding process varies for different types of credit products. For credit cards, customers apply online or in person, receive approval, activate the card, and start using it.

For loans, customers submit applications, provide documentation, undergo underwriting, receive approval, and start repayment. Mortgages involve pre-approval, application, property appraisal, underwriting, approval, and repayment.

For loans, customers submit applications, provide documentation, undergo underwriting, receive approval, and start repayment. Mortgages involve pre-approval, application, property appraisal, underwriting, approval, and repayment.

Ready to further explore digital lending software ACP

REACH OUT TO OUR EXPERTSEmpowering Digital Lending

Get all resources your need !

All Resources