The effective management of credit lines is critical for financial institutions to mitigate portfolio risk, maintain profitability, and safeguard against potential financial downturns.

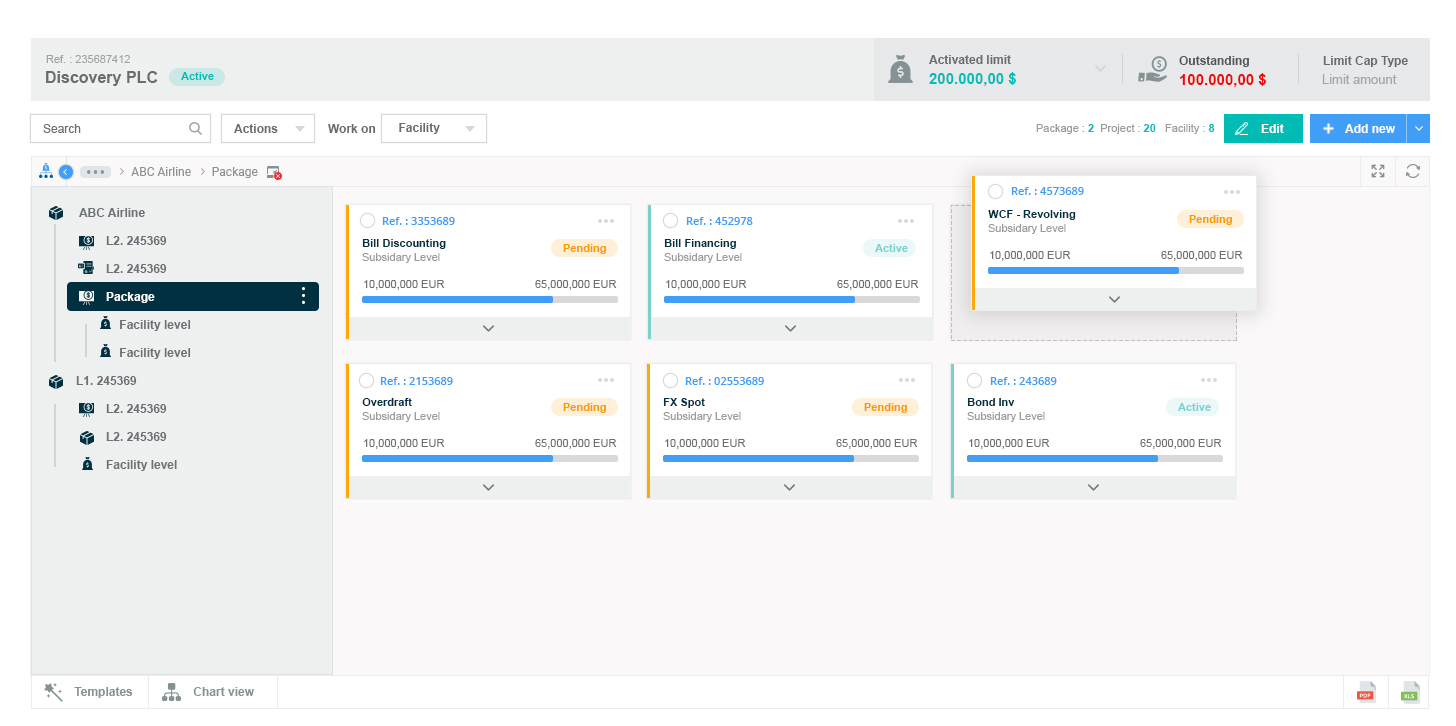

ACP Limit management offers a digital solution for proactive monitoring and centralized observation of credit limits across business segments, enhancing risk management and operational efficiency

Request a demo of ACP Limit Management

ACP Limit management offers a digital solution for proactive monitoring and centralized observation of credit limits across business segments, enhancing risk management and operational efficiency

Streamlining limits: automated efficiency and credit risk control

1/ Limit request/Setting Limits

Establishing credit limits for borrowers based on factors such as creditworthiness, income, and existing debt obligations.

2/ Monitoring Limits

Regularly monitoring borrowers' credit utilization and payment behavior to ensure compliance with established limits.

3/ Adjusting Limits

Making adjustments to credit limits as necessary based on changes in borrowers' financial circumstances or credit risk profiles.

4/ Reviewing Limits

Periodically reviewing and reassessing credit limits to ensure they remain appropriate and aligned with risk management objectives.

5/ Enforcing Limits

Enforcing credit limits by declining transactions or taking other appropriate actions when borrowers exceed their approved limits.

6/ Reporting and Analysis

Generating reports and conducting analysis to evaluate the effectiveness of limit management strategies and identify areas for improvement.

Unlocking profit potential with automated credit limit management

Enhanced accuracy in credit risk and profitability across diverse business segments

- Monitor facility limits automatically

- Handle complex multi-level limit structures

- Capture the full limit terms and conditions

- Handle all types of limits including Settlement and Pre-Settlement limits

- Manage time-bucket limits for Derivatives

- Aggregate utilizations at any level of the limit structure

- Perform from real-time pre-deal check limit breaches

- Respond immediately to customer utilization requests

- Manage limit lifecycle events

- Generate statistics on utilization levels across the limit lifecycle

- Dynamic limits, LTV thresholds monitored in real-time

- Limit warning thresholds allowing an early risk awareness

- End-to-end data and information integrity and coherence from origination to limit monitoring

- Online access to the entire history of limits: initiation, events, renewals, and excesses

- Powerful real-time pre-deal checking

- Multi-dimensional portfolio aggregation strategies

- Historical portfolio snapshot storage, slice and dice credit data analyses, dashboards, and dynamic reports building.

- Advanced portfolio analysis features

- Flexibility of unlimited add-ons of aggregation strategies, new exposures, and consolidation path definitions.

- Pre-configured OLAP cubes, dashboarding environment, and MIS reporting.

- Automated and faster credit risk consolidation process across the bank portfolio

- Slice and dice views of the credit portfolio through multiple dimensions

- Multi-dimensional view of the portfolio consolidation strategies

- Enterprise-wide risk reporting of credit-related activities

- Portfolio limits across a combination of dimensions and monitoring of breaches, excesses, and exposures

- Ensured regulatory compliance on concentration limits

Axe Credit Portal is trusted by

Limit management

FAQ

Limit management refers to the process of setting, monitoring, adjusting, and enforcing credit limits for borrowers or accounts within a financial institution. This process ensures that borrowers are granted appropriate levels of credit based on their creditworthiness and financial situation while mitigating the risk of default or overextension. Limit management involves establishing credit limits, monitoring credit utilization and payment behavior, making adjustments to limits as needed, enforcing limits to prevent excessive borrowing, and analyzing the effectiveness of limit management strategies. It is a critical aspect of credit risk management within financial institutions to maintain a healthy balance between risk and profitability.

Limit management focuses on setting, monitoring, and enforcing credit limits for borrowers or accounts to control credit exposure. It involves tasks like establishing, adjusting, and enforcing credit limits.

Credit management, on the other hand, is a broader concept covering the entire credit lifecycle, including origination, underwriting, monitoring, collection, and risk mitigation. It encompasses activities like assessing creditworthiness, evaluating loan applications, monitoring repayment, managing delinquencies, and minimizing credit losses

Yes, limit management can vary based on the specific credit segments or business lines within a financial institution. Different segments may have distinct risk profiles, regulatory requirements, and customer needs, leading to unique approaches in setting and managing credit limits. For example, limit management in commercial lending may focus on assessing corporate creditworthiness and establishing credit lines for businesses, while limit management in consumer lending may involve setting individual credit limits for retail customers based on their financial profiles and repayment capabilities.

Ready to further explore ACP Limit Management software

REACH OUT TO OUR EXPERTSEmpowering.

Digital.

Lending

Get all resources your need !

All Resources