Lenders are encountering growing demand for mobile-friendly credit process management to meet evolving customer expectations, particularly in today's mobile-centric landscape. ACP Omnichannel enables a customer-centric approach by offering a flexible omnichannel banking solution, empowering credit stakeholders to seamlessly engage across multiple channels and devices.

Request a demo of ACP Omnnichannel

Ensuring risk mitigation and consistent credit processes across devices, channels, and stakeholders

1/ Credit application Initiation

Simulate and apply for a loans across all channels and devices (branches, point-of-sale, mobile, desktop, and credit eligibility notifications)

2/ Documents upload

Borrowers submit required documents and information to support loan applications through multiple channels.

3/ Credit Risk assessment

Lenders underwrite credit based on predefined criteria, data from channels to assess creditworthiness (Automatic Data extraction).

4/ Multi-channel notifications

Lenders communicate decisions to borrowers through their preferred channels (email, mobile, customer portal, partner portal etc.)

5/ Digital contract signature

Borrowers swiftly complete loan applications across multiple channels, ensuring authenticity while having a seamless, paperless processing.

6/ Disbursement and servicing

Loans disbursed to borrowers through their preferred channels. (bank account, credit card loan limit). Omnichannel servicing capabilities allow for monitoring and post-approval requests.

Smart and scalable omnichannel lending solution

Digital lending orchestrated across all channels

ACP Omnichannel Banking Solution combines ACP Business Services designed around the following four building blocks:

- wACP: composed of fine-grained business service components enabling lenders to craft omnichannel financing journeys.

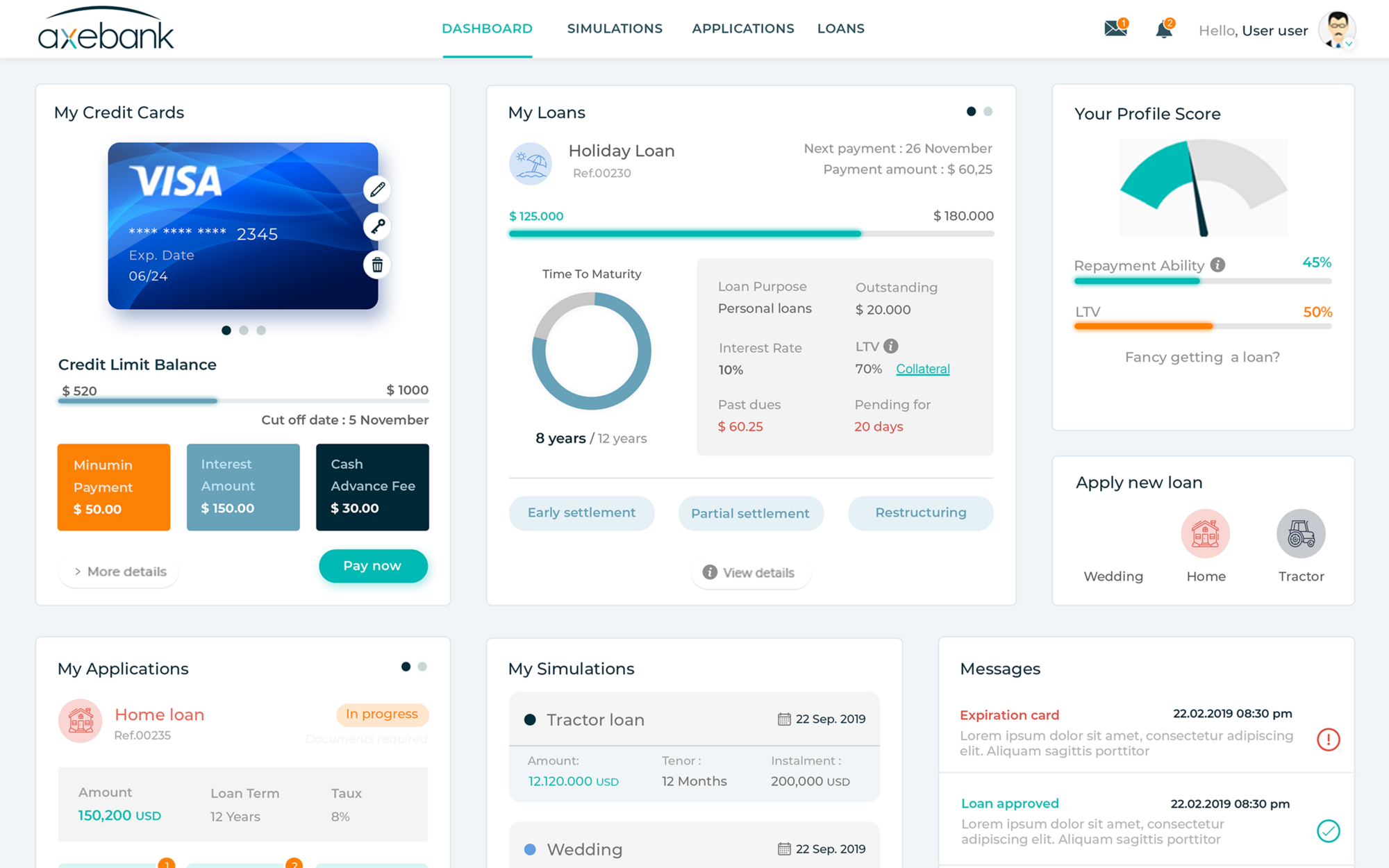

- myACP: is the customer portal access (mobile & web) to credit products offered by the bank or the partner.

- mACP: is the mobile application dedicated to bankers who use ACP’s main functions through their mobile devices.

- pACP: is the bank’s front-end access (mobile & web) for partners, credit distributors, and external stakeholders, enabling them as digital credit enablers and unlocking new channels and revenue streams.

ACP Omnichannel’s robust set of APIs allows credit stakeholders to perform their duties over multiple touchpoints of the credit lifecycle, a credit application can be:

- Launched by a partner through pACP.

- Assessed by the bank relationship manager through ACP.

- Approved by the decision maker through mACP.

- Contractually and digitally signed by the customer through myACP.

- Automatically sent to the Core Banking System for disbursement.

- Built-in chat feature allowing the bank users to exchange messages within the context of the CA.

- Loan simulator: the simulation engine can be made available to help fine-tune loan pricing.

- Quick loan origination and credit application status tracking.

- Generation and credit documentation downloads.

- Review, attach, and download credit application-related documents.

- Eligibility rules for precise product offers in compliance with internal credit policies and regulations.

- Illustration of the credit application limit structure.

- Global and quick search options.

- Streamlined workflow tasks across all channels

- Push notifications across all devices.

Axe Credit Portal is trusted by

Ready to further explore digital lending software ACP

REACH OUT TO OUR EXPERTSEmpowering Digital Lending

Get all resources your need !

All Resources