For banks, reliance on traditional and manual origination processes can be time-consuming and resource-intensive. Manual data entry and document processing, along with poor data quality and integration, pose the risk of inconsistencies and make the process prone to errors.

ACP Loan Origination solutions allows lenders to prioritize customer-centric approaches to origination through a single-entry comprehensive platform that streamlines the origination process, standardizes workflows, and enhances operational efficiency.

Request an ACP Loan Origination solution demo

The power of streamlined automated Loan Origination Process

1/ Credit application (CA)

Prompt loan inquiry collected across channels and devices

2/ Document collection

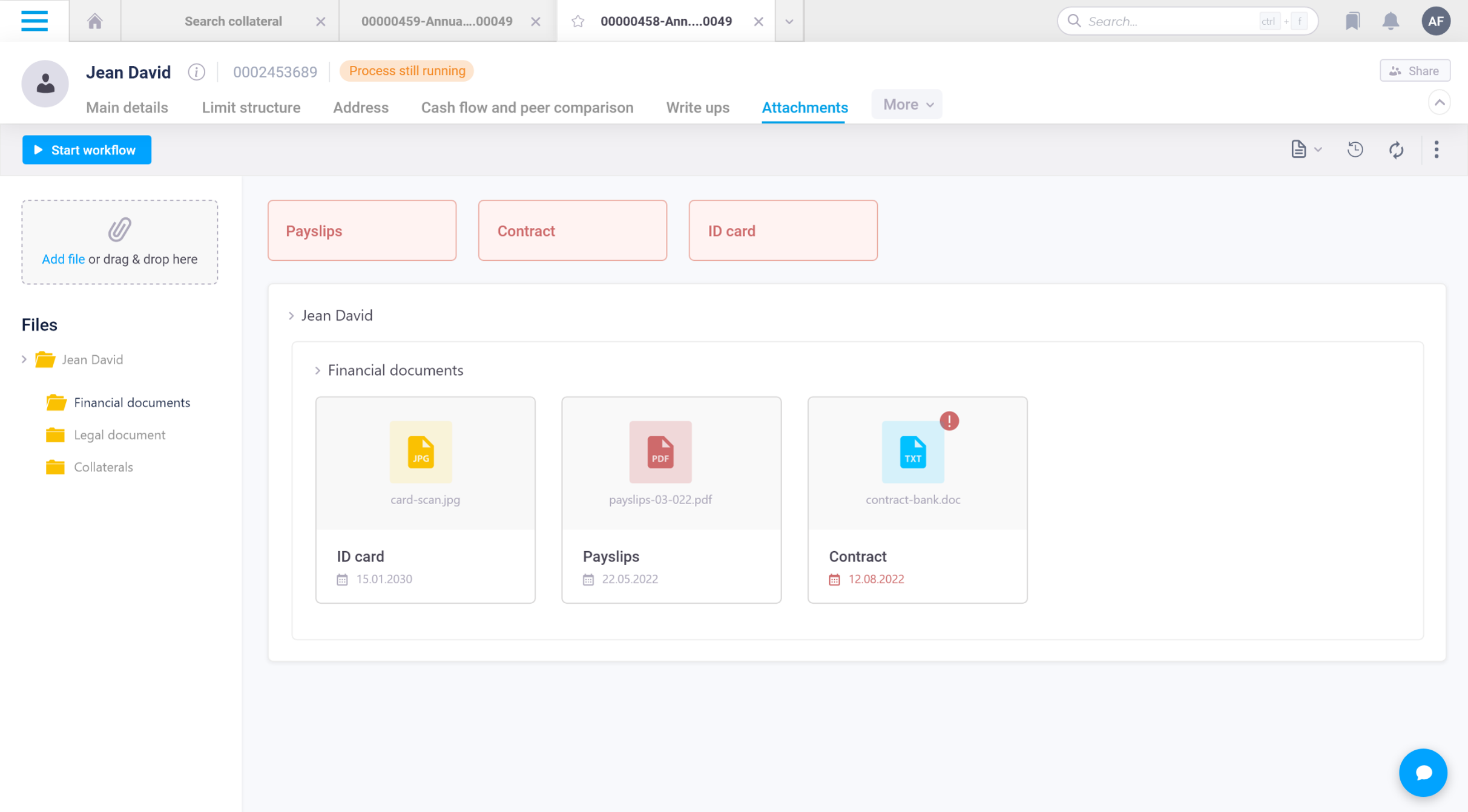

AI-powered credit documents collection and extraction (OCR)

3/ Document verificaton

AI-powered analysis of the documents against extracted data and existing records

4/ Identity verification

Verification of the credit documents matched against existing KYC records

5/ Credit assesment

AI-based analysis of the customer's risk profile based on various factors

6/ Automatic credit decisioning

Automated systems decide on whether to approve, reject, or escalate the application

Smart and flexible loan origination solution tailored to every lender's needs

Satisfying customers at the first touchpoints with a seamless origination process

- Streamlined customer application initiation and document collection across multiple channels using automated processes.

- Enhanced document verification with Optical Character Recognition (OCR) technology for accuracy and efficiency.

- Implementation of specialized automated verification protocols enables bankers to efficiently collect and authenticate required identification documents and applicant information

- Increased focus on credit applications needing further risk analysis and human assessment.

- Continuous refinement of risk policies and model parameters.

- Seamless integration with external data sources, such as credit bureaus, enhances decision-making accuracy.

- Automatic approval and rejections with ACP Scoring reduce workload.

ACP Loan origination solution is trusted by

Loan Origination

FAQ

Loan origination softwares, such as Axe Credit Portal (ACP), is a digital platform designed to automate and streamline the lending process for banks and financial institutions. ACP facilitates end-to-end loan origination, from KYC, approval, scoring and decisioning and up to servicing, enhancing operational efficiency and improving borrower satisfaction.

An AI-powered digital lending solution, such as ACP, offers numerous benefits to banks and financial institutions, including accelerated loan processing, reduced operational costs, enhanced risk management, improved compliance, and increased customer satisfaction. By leveraging the latest AI innovations to automate manual tasks and integrating with existing systems, ACP empowers lenders to make faster, more informed lending decisions while minimizing risk.

From adjusting workflow processes to modifying decision-making criteria, the configuration tools provide granular control over every aspect of the lending lifecycle. With intuitive drag-and-drop interfaces and configurable parameters, you can easily configure rules, templates, and workflows to align with the bank’s specific changing needs. Additionally, the tool supports dynamic adaptation, allowing you to evolve and refine your lending practices over time without extensive redevelopment

Ready to further explore Loan Origination Software ACP

REACH OUT TO OUR EXPERTS

Get all resources your need !

All Resources