Solutions

ACP SCORING

Empowering automated credit decisions with accurate scoring

and creditworthiness assessment

Traditional static scorecards lack the accuracy needed in an age of data-powered modeling. ACP Scoring combines both rule-based and AI scoring approaches for precise credit assessment, improving loan decisions through dynamic self-tuned models.

Request a demo of ACP Scoring

Enhanced loan assessment through dynamic credit scoring solutions

Risk Profiling

Customer risk profile is identified. His/her behavior is carefully tracked and changes to detected patterns are reported.

Micro-Segmentation

Comprehensive screening and categorizing credit portfolios using advanced AI algorithms and producing multiple models to accurately score specific segments.

Big Data Analysis

Extract, transform, load, explore, consolidate, and mine huge volumes of structured and unstructured data.

Pipeline Management

An AI/ML framework allowing tech-savvy business experts to build pipelines to explore/process data and to produce, validate, and deploy AI-Powered models.

Data-driven Models

New analytical perspectives include all customer data, account activity, ATM transactions, and any available tracked interactions.

Continuous monitoring

Model performance is continuously monitored. Data quality and distribution are regularly checked, and models adjusted accordingly.

Empowering lenders with flawless and precise credit decisions

Unlock precision with a combination of traditional and AI-driven integrated credit scoring solution

- AI-powered scoring models.

- Greater insight into an applicant’s ability to pay the debt.

- Accurate portfolio segmentation such as multiple correspondence analysis and unsupervised clustering.

- Granular scorecardization.

- Extension of credit to deserving applicants who would have been denied a loan using previous methods.

- Select the most relevant features and data to develop precise models.

- Strike the right balance between risk appetite, cost reduction, policy compliance, and customer experience.

- Reduced workload thanks to automatic approval and rejections from axeScoring.

- Increased focus on credit applications that require further risk analysis and human assessment.

- Continuously fine-tune risk policies and tweak model parameters.

- A wide range of features supports the ingestion and processing of structured and unstructured data.

- Produce and deploy high-performing AI-based scoring models.

- Powerful set of APIs allowing the integration of scoring models with third-party systems.

- Compare real observations vs AI-based decisions thanks to advanced dashboards and charts provided to monitor the models.

- Real-time alerts to prevent uncontrolled model and data drifts.

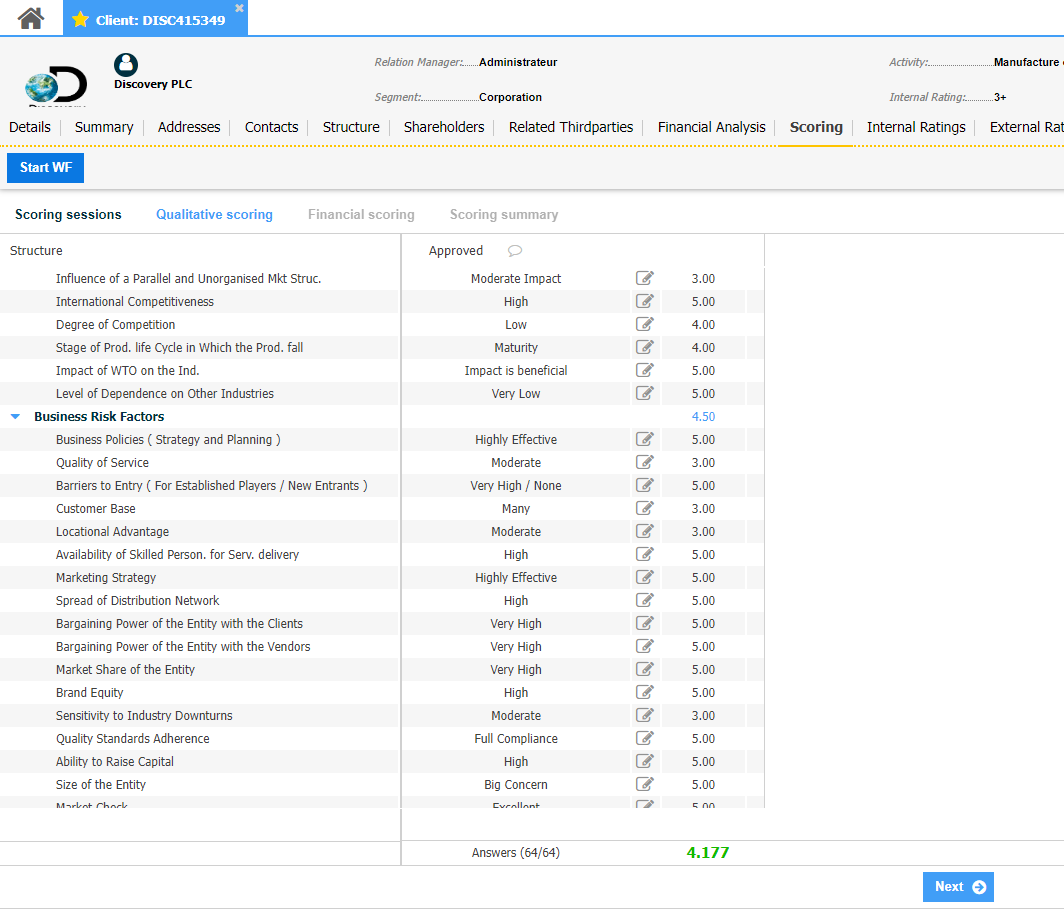

ACP Scoring is trusted by

Credit Scoring

FAQ

Credit scoring is a statistical method used by lenders to evaluate the creditworthiness of individuals or businesses applying for credit.

It involves analyzing various factors such as credit history, income, debt-to-income ratio, and other relevant financial information to assign a numerical score. This score helps lenders assess the likelihood that a borrower will repay their debts on time.

Credit scoring is a crucial tool in the underwriting process as it enables lenders to make more informed decisions about extending credit.

It involves analyzing various factors such as credit history, income, debt-to-income ratio, and other relevant financial information to assign a numerical score. This score helps lenders assess the likelihood that a borrower will repay their debts on time.

Credit scoring is a crucial tool in the underwriting process as it enables lenders to make more informed decisions about extending credit.

Credit scoring, enhanced by Artificial Intelligence (AI), is a statistical technique employed by lenders to assess the creditworthiness of applicants.

It utilizes various data points such as credit history, income, and debt levels to generate a numerical score, helping lenders in predicting the likelihood of timely loan repayment. This AI-driven process enables more informed credit decisions and enhances the efficiency of the underwriting process.

It utilizes various data points such as credit history, income, and debt levels to generate a numerical score, helping lenders in predicting the likelihood of timely loan repayment. This AI-driven process enables more informed credit decisions and enhances the efficiency of the underwriting process.

One of the most challenging aspects of the credit scoring stage is the accurate assessment of risk, especially when dealing with large volumes of data and complex borrower profiles.

Automation can address this challenge by leveraging advanced algorithms and machine learning techniques to analyze vast amounts of data quickly and accurately. By automating the credit scoring process, ACP scoring help lenders ensuring consistency, reducing human error, and making more precise risk assessments, ultimately leading to better lending decisions.

Automation can address this challenge by leveraging advanced algorithms and machine learning techniques to analyze vast amounts of data quickly and accurately. By automating the credit scoring process, ACP scoring help lenders ensuring consistency, reducing human error, and making more precise risk assessments, ultimately leading to better lending decisions.

Ready to further explore digital lending software ACP

REACH OUT TO OUR EXPERTSEmpowering Digital Lending

Get all resources your need !

All Resources