The eternal digital lending debate: build in-house or buy from experts?

In the fast-evolving world of financial technology, bankers are increasingly faced with a critical decision: should they develop their digital lending solution internally or partner with an external vendor? Both approaches offer distinct advantages and challenges, and the choice can significantly impact an organization’s efficiency, flexibility, and overall success. Together, let’s delve into the pros and cons of each possibility to help you make an informed decision.

Internal development: customization and control

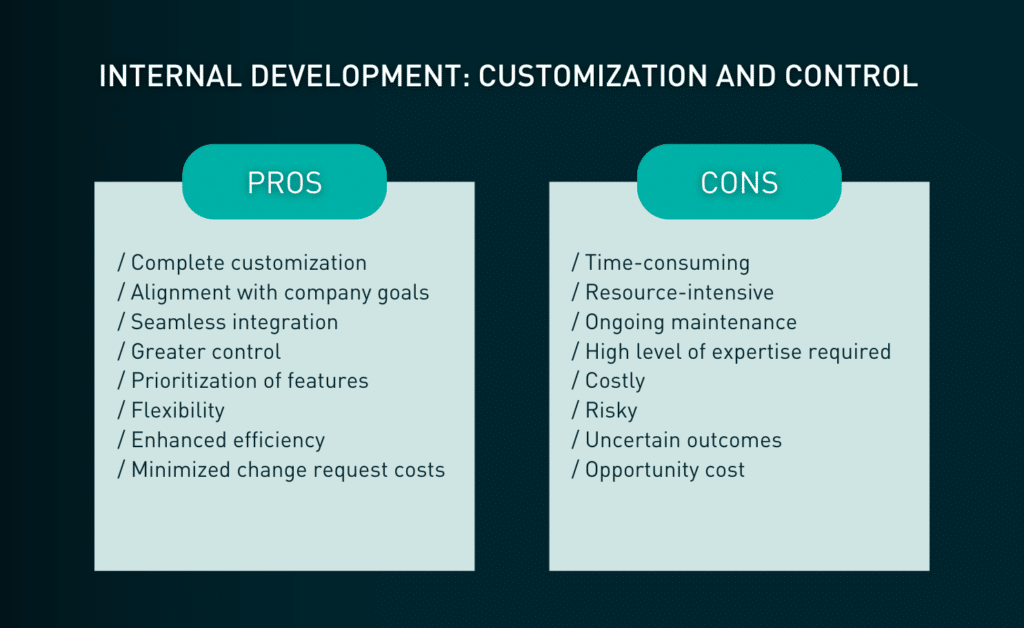

Developing a digital lending solution internally offers the advantage of complete customization and control. By building the solution in-house, banks can tailor it precisely to their specific needs, workflows, and regulatory requirements. This level of customization ensures that the solution aligns perfectly with the organization’s goals and integrates seamlessly with existing systems.

Moreover, internal development provides greater control over the development process and future updates. Institutions can prioritize features based on their unique requirements and adjust as needed without relying on external timelines or constraints. This approach can lead to a highly personalized and well-integrated solution, enhancing operational efficiency and user satisfaction.

Internal development presents several challenges. The process can be time-consuming and resource-intensive, requiring significant investment in technology, talent, and ongoing maintenance. Additionally, developing and maintaining a digital lending solution internally demands a high level of expertise in both software development and the complexities of lending processes. Despite these investments, the uncertain outcome of such efforts is a significant concern, as internal development does not guarantee a successful result. Projects can suffer from scope creep, unforeseen technical challenges, or misalignment with business goals, leading to potential delays or failures. For some institutions, the costs and risks associated with internal development may outweigh the benefits.

External vendor: speed and expertise

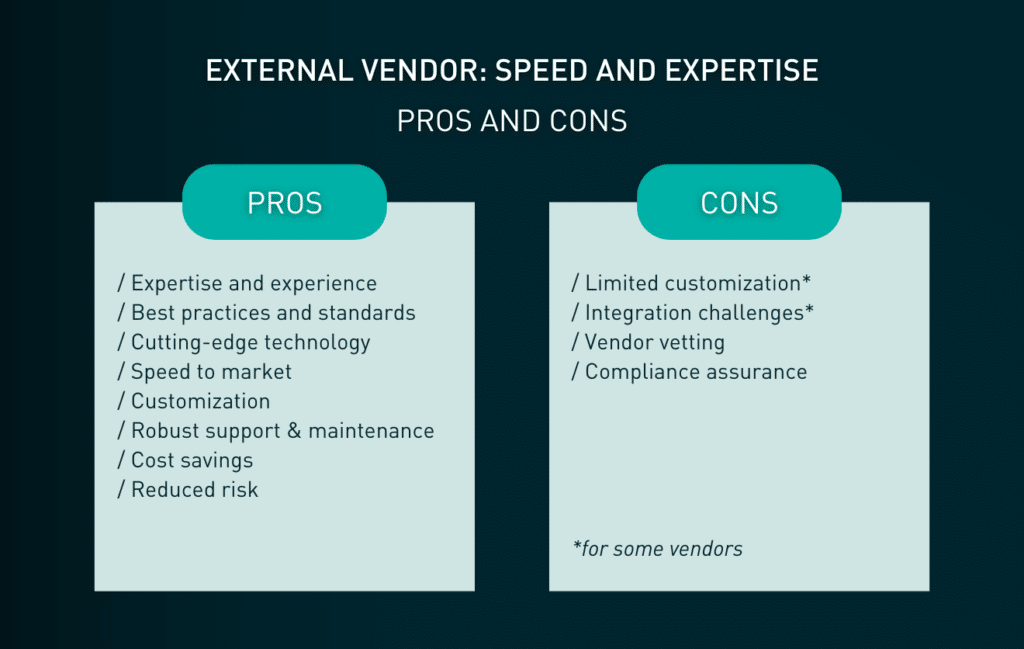

Partnering with an external vendor for a digital lending solution offers several compelling advantages. Vendors specializing in digital lending solutions, especially those with a sole focus on the end-to-end credit process, bring extensive expertise and experience to the table. You can guarantee that the solution is built based on best practices and industry standards, ensuring that banks benefit from cutting-edge technology with the latest market innovations and compliance with regulatory requirements.

Opting for external vendors can also accelerate the implementation process. With a ready-to-deploy solution, institutions can quickly integrate the system, create customizations based on internal policies and requirements, and start reaping the benefits without a lengthy development timeline associated with internal projects. This speed to market can be crucial for staying competitive in the rapidly evolving financial landscape.

Moreover, external vendors typically offer robust support and maintenance services. Banks can rely on the vendor to handle updates, security patches, and troubleshooting, allowing internal teams to focus on core business activities. This can result in lower overall costs and reduced risk compared to managing an in-house solution.

However, choosing an external vendor also comes with considerations. Customization options may be limited compared to internal development, and there may be concerns about integrating the vendor’s solution with existing systems. Additionally, institutions must carefully vet vendors to ensure that their solutions align with organizational needs and comply with relevant regulations.

Hybrid approach: best of both worlds

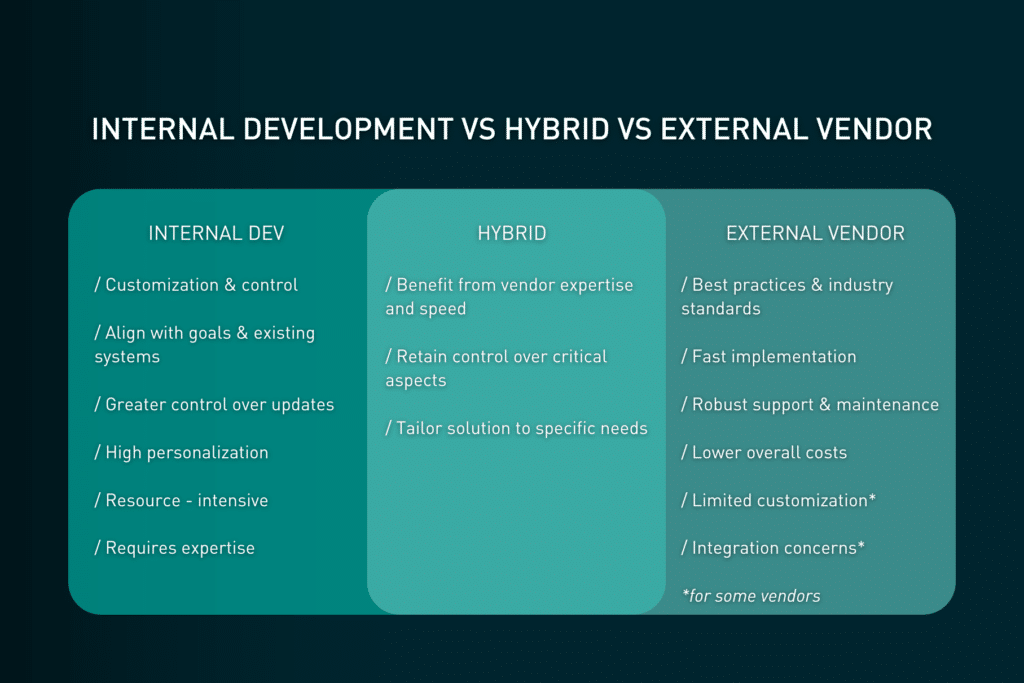

For some banking institutions, a hybrid approach may offer the best of both worlds. This strategy involves using a combination of internal development and external vendor solutions. Institutions can leverage external vendors for core functionalities while customizing and integrating specific features internally. This approach allows organizations to benefit from the vendor’s expertise and speed while keeping control over critical aspects of the solution.

Deciding between internal development and partnering with an external vendor for a digital lending solution requires careful consideration of a range of factors, including customization needs, resource availability, time constraints, and long-term goals. Internal development offers customization and control but can be resource-intensive, while external vendors provide speed and expertise.

Finding the best partner for loan origination solutions is crucial when deciding whether to opt for internal development or an external vendor. Axe Finance stands out as a flexible and composable solution, offering the best of both worlds.

Axe Finance offers a flexible and customizable digital lending solution through the Axe Credit Portal (ACP). The modular design of the platform ensures that ACP can accommodate the diverse needs of bankers across all segments and stages of the credit lifecycle. ACP, with its robust API, can also seamlessly integrate with all third-party systems, ensuring a smooth and efficient implementation process. This combination of flexibility, customization, and integration capability allows lenders to benefit from a comprehensive and adaptable digital lending solution, making Axe Finance the trusted partner for reputable banks in their digital transformation initiatives across the globe.

How Société Générale chose ACP to integrate with its internal solutions and third-party systems for enhanced efficiency

Despite its internal development capabilities, Société Générale (SG) chose ACP for its international subsidiaries to achieve faster market entry and enhanced efficiency. ACP's robust framework and tools empower SG to manage diverse products and clients across geographies, accommodating various policies, languages, and currencies while ensuring compliance, a typical case of a hybrid approach (internal and external development).

Youness NFISSI, Retail Manager at Société Générale said:

Société Générale Group is growing business very rapidly and successfully in around 20 African countries. In order to support its development and fully catch the continent’s growth potential, we were looking for a cutting-edge credit granting tool, that adjusts to multibank setup and allows for digital, reliable, and fast processing. We are very confident that Axe Finance's technology will significantly contribute to making our clients’ experience even more unique.

Explore the Société Générale case study