Top Lending Automation Mistakes That Banks Should Avoid

Listen to the Axe Finance podcast

As banks increasingly embrace digital transformation in lending, avoiding critical mistakes is essential to ensure efficiency, compliance, and customer satisfaction. The digitalization journey, while full of opportunities, is also fraught with challenges, and missteps can lead to significant financial losses, regulatory penalties, and reputational damage. According to McKinsey, approximately 70% of digital transformations in the banking sector exceed their original budgets, with 7% costing more than double the initial projection. Furthermore, only 30% of banks have successfully implemented their digital strategy.

Despite these challenges, successful digital transformation delivers substantial rewards. Digitally advanced banks have seen a 20% increase in return on equity and a 30% reduction in their cost-to-income ratio (McKinsey, 2024). Additionally, digital-first banks are outperforming traditional institutions in customer satisfaction, with some achieving over 80% recommendation rates (Financial Times, 2025).

To thrive in this evolving landscape, banks must recognize and avoid common pitfalls:

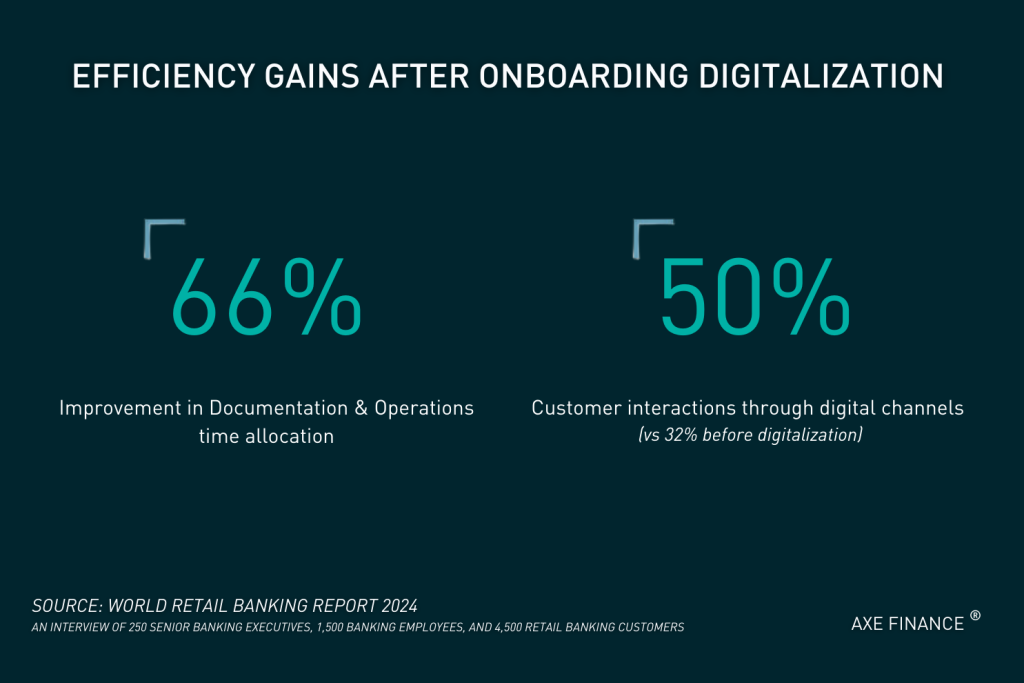

1. Complicated and Lengthy Digital Onboarding

Complicated onboarding often stems from legacy systems, siloed processes, or an overemphasis on compliance and security, resulting in slow and cumbersome experiences that lead to high abandonment rates.

Banks can reduce friction by adopting fast omnichannel experiences with digital identity verification, e-signatures, and AI-driven document processing. Streamlining data validation and minimizing manual steps creates a seamless journey that boosts completion rates, customer satisfaction, and operational efficiency.

2. Modernizing Risk Models: Balancing Tradition and Innovation

For banks using traditional credit scoring models, relying solely on rule-based assessments can limit their ability to accurately evaluate borrower risk, leading to missed opportunities and increased defaults. Meanwhile, other banks looking to modernize their risk models are turning to AI-driven scoring and big data analytics to gain deeper insights into creditworthiness.

By incorporating alternative data sources, such as transaction history, utility payments, and behavioral patterns, these advanced models offer a more comprehensive view of borrowers, especially underbanked customers. However, maintaining fairness, explainability, and compliance remains crucial as these models evolve.

3. Managing AI Bias and Ensuring Model Transparency

AI and machine learning are critical for improving credit risk assessment, but poorly trained models can introduce unintended biases, leading to discriminatory outcomes and compliance risks. Regulatory frameworks like the EU’s AI Act and GDPR require banks to ensure transparency and fairness in AI-driven decisions. If models unintentionally penalize certain demographics or overlook key data, it can perpetuate systemic inequality.

To address these risks, banks must integrate fairness and bias prevention into the model design, using explainable AI (XAI), diverse datasets, and continuous audits. This approach ensures compliance, fosters equitable lending decisions, and protects both customer trust and the bank’s reputation.

Example of AI Bias and XAI Solution:

AI bias in lending models can result in unfair loan denials for minority groups due to biased training data. Explainable AI (XAI) helps by providing transparency on decision-making factors like credit score and income. This enables banks to detect and correct biases, ensuring equitable loan approvals and compliance with fairness regulations.

4. Incomplete Credit Lifecycle Automation

While many banks have automated parts of the lending process, such as loan approvals, they often overlook critical steps like servicing, repayments, and collections. This partial automation leaves gaps that increase operational risks, reduce efficiency, and complicate performance tracking.

Banks must decide whether to adopt an end-to-end platform like ACP, which offers seamless automation and composability, or assemble best-of-breed solutions for each step. While best-of-breed systems offer specialized features, they require strong integration and centralized reporting to avoid silos. ACP, on the other hand, provides flexibility with its modular design, allowing banks to select and integrate the components that best fit their needs while ensuring a cohesive, streamlined experience across the entire lending process.

With ACP, banks gain a unified view of the entire credit lifecycle, thanks to robust API-driven integrations. Even when different systems are utilized for distinct stages of the credit process, ACP can seamlessly connect them, acting as a single-entry point for all credit lifecycle stages. This ensures end-to-end visibility, real-time performance tracking, and a holistic approach to credit management.

5. Integrating ESG and Green Lending into Digital Transformation

As ESG criteria and green financing gain traction, banks that have yet to integrate these elements into their digital lending automation risk missing both growth opportunities and regulatory incentives. Many governments are actively encouraging green loans through grants, tax benefits, and preferential interest rates. For example, the EU offers lower capital requirements for banks financing sustainable projects (LSE, 2017). Meanwhile, Singapore provides grants for green and sustainability-linked loans (ASEAN Briefing, 2020), and Canada offers tax credits and subsidies for clean technology investments (U.S. Department of State, 2024).

However, leading banks may already have ESG frameworks in place, yet they may face challenges in embedding ESG considerations across the entire lending lifecycle. For these banks, the focus should be on seamless ESG integration, enabling them to assess sustainability and offer green loans without disrupting existing processes. Digital lending solutions with built-in ESG capabilities can help banks track sustainability metrics, ensure compliance with evolving regulations, and avoid greenwashing by leveraging transparent, auditable models. Ultimately, a comprehensive approach to ESG lending will not only strengthen compliance but also open new growth avenues in the eco-conscious lending market.

6. Underutilizing Personalization Capabilities in Automation

While automation accelerates time-to-market for new products, some banks fail to fully leverage its potential for personalization. Relying on standardized loan products overlooks key borrower differences such as creditworthiness, income patterns, and risk tolerance, resulting in missed opportunities.

Advanced digital lending solutions use AI, real-time data, and increasingly Open Banking and Open Accounting data to tailor loan terms, interest rates, and repayment schedules to each borrower’s unique profile. These data sources enhance the personalization of lending decisions, offering a more holistic view of the borrower. AI-powered cross-selling recommendation models further enhance engagement and conversion by delivering personalized offers that meet individual needs.

7. Maximizing Performance with Continuous Optimization

Although most banks understand the importance of KPIs like approval rates, fraud detection efficiency, and customer satisfaction, the real challenge lies in continuously optimizing those metrics. Even for banks that track KPIs, failing to integrate real-time analytics and adaptive optimization can result in missed opportunities to refine strategies or address emerging risks.

By leveraging advanced digital lending solutions that integrate real-time data, banks can actively monitor performance, identify bottlenecks, and dynamically refine algorithms for better outcomes. Continuous optimization, such as adjusting risk models or enhancing customer experience, ensures that banks not only stay compliant and efficient but also adapt to evolving market demands, driving long-term growth and enhancing borrower satisfaction.

8. Underestimating Compliance Complexity in Automation

While automation is often adopted to meet regulatory requirements, it can introduce new compliance risks if not managed properly. Evolving regulations like KYC (Know Your Customer), AML (Anti-Money Laundering), and GDPR require constant updates and monitoring. Failure to align automated workflows with these changes can result in significant fines, as seen in 2024 when Starling Bank was fined £29 million by the UK's Financial Conduct Authority (FCA) for lapses in financial crime controls (The Guardian, 2024). Similarly, in 2025, the FCA fined investment firm Mako £1.7 million for failing to prevent financial crime related to cum-ex trading schemes (Reuters, 2025).

The right digital lending solution ensures continuous compliance by integrating real-time updates, centralized data management, and automated reporting to reduce human error and improve regulatory adherence.

9. Inefficient Integration with Legacy Systems

Many banks face challenges integrating modern lending automation with outdated core systems, leading to data silos, operational bottlenecks, and limited scalability. Legacy infrastructure often lacks the flexibility needed for seamless digital transformation, making upgrades costly and time-consuming.

Digitalizing loans should be part of a broader strategic rethink of the bank’s digital strategy, ensuring that new solutions align with long-term business goals. A modular, API-based approach enables smoother integration, facilitating data flow and interoperability with third-party systems while minimizing disruptions.

In today’s fast-evolving digital lending landscape, banks must navigate challenges like ensuring compliance, optimizing risk models, enhancing customer experiences, and embracing emerging trends such as AI, ESG, and personalized lending. Addressing these issues requires a balance of strategic integration, continuous optimization, and a commitment to innovation. By overcoming these pitfalls, financial institutions can enhance operational efficiency, drive sustainable growth, and remain competitive in an increasingly complex market.

With Axe Credit Portal (ACP)’s comprehensive capabilities in end-to-end automation, AI-driven insights, and seamless third-party integrations, banks can optimize their lending processes while staying aligned with industry advancements. To learn more about how we can help future-proof your digital lending strategies, we invite you to connect with our experts for personalized insights!